Greetings

This is Ravi Verma, In this Article, I will show you how to pay the TDS on the Income tax portal.

Let’s Begin,

The government has Inserted a new way for the payment of TDS on the income tax portal.

Please follow these steps after that you can pay your TDS very easily.

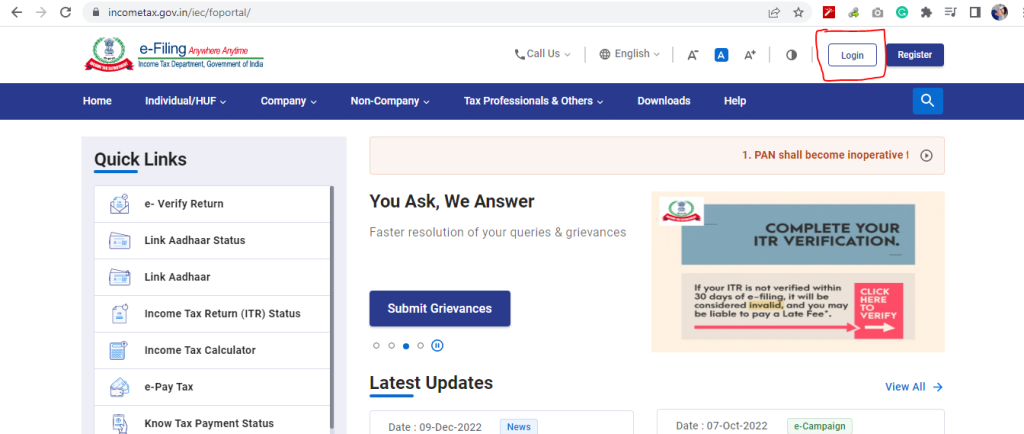

- Please go ahead and open your window and incometax.gov.in on it.

- After clicking on it, click on the login button.

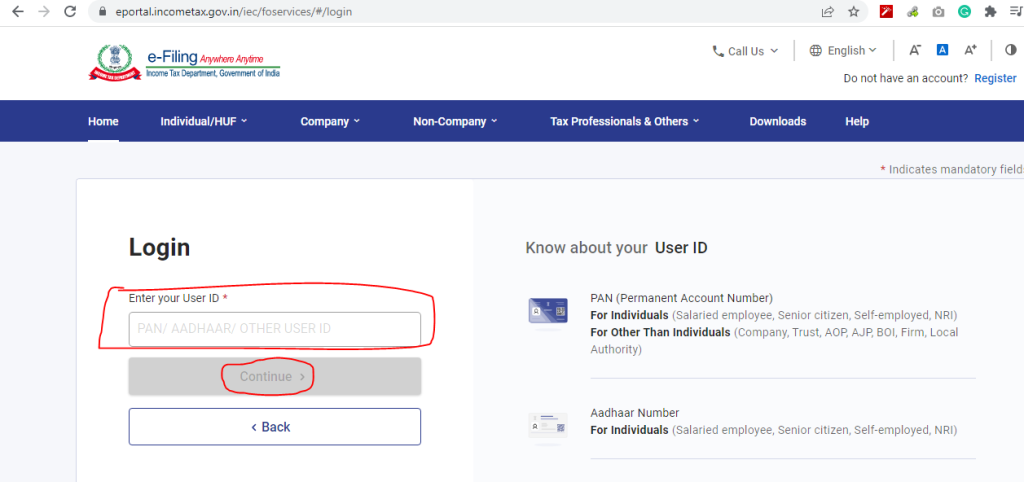

- Inter your TDS login id and click on the continue button.

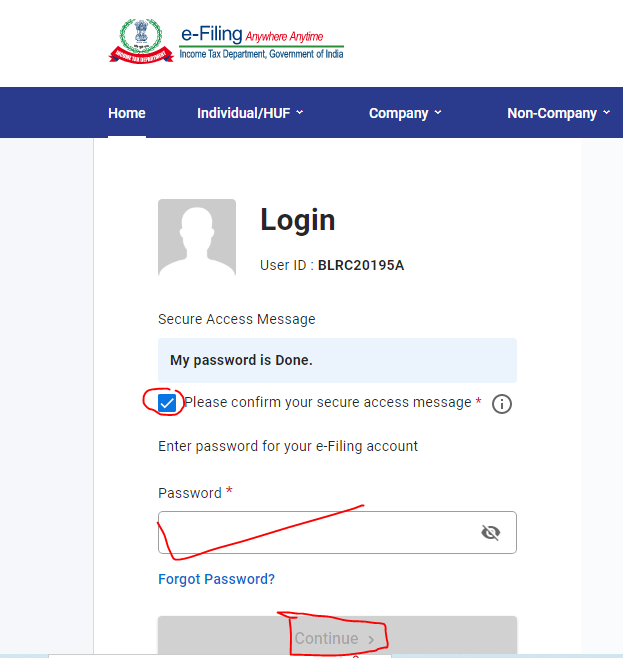

- After that please tick the indicated box i.e Please confirm your secure access message and also enter your password lastly click on the continue button.

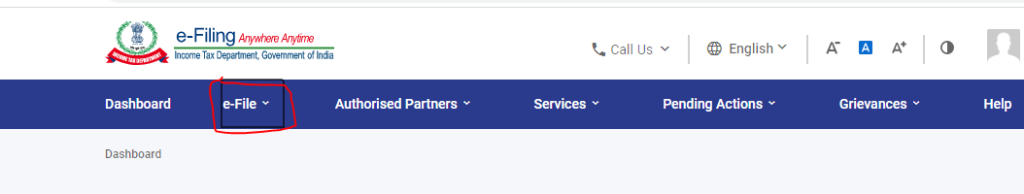

- Now click on the e-File button.

- Under this option, you will see the e-pay tax option then click on it.

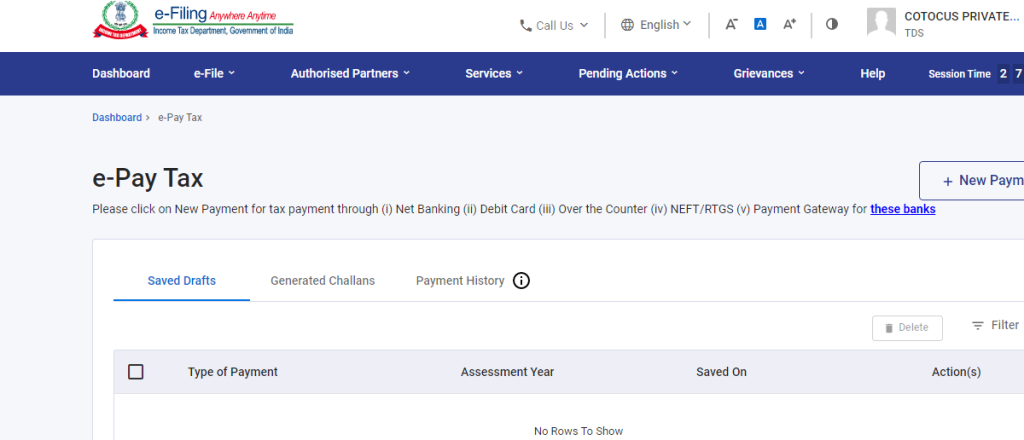

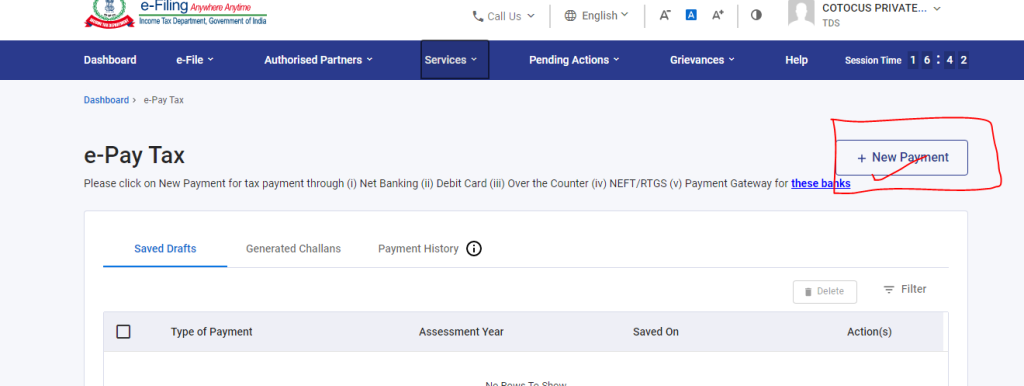

- After clicking on it you will be entering the dashboard of e-pay tax.

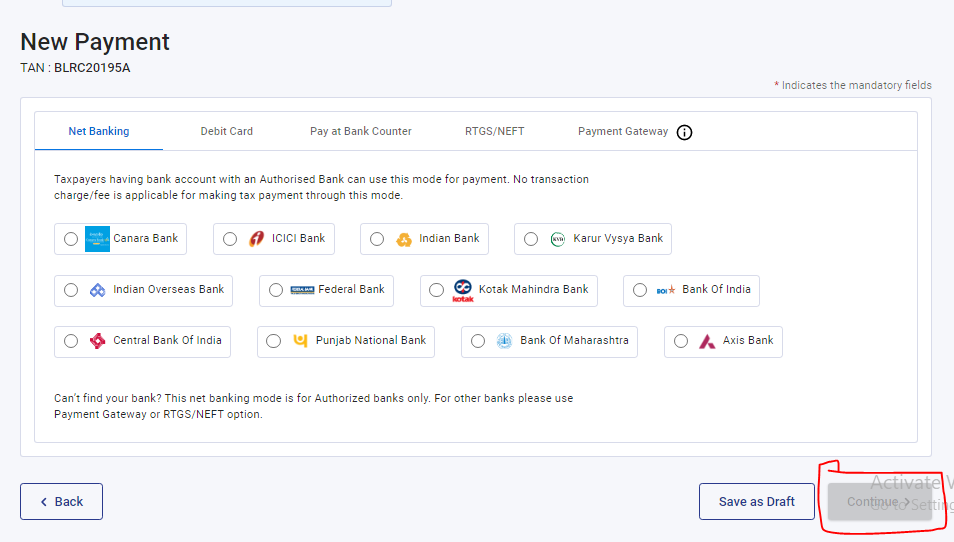

There is a pop-up message about bank payments, please click on this hyperlink, and here are the bank names.

Authorized Banks List

Axis Bank

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Federal Bank

ICICI Bank

Indian Bank

Indian Overseas Bank

Karur Vysya Bank

Kotak Mahindra Bank

Punjab National Bank

- Please click on the new payment button.

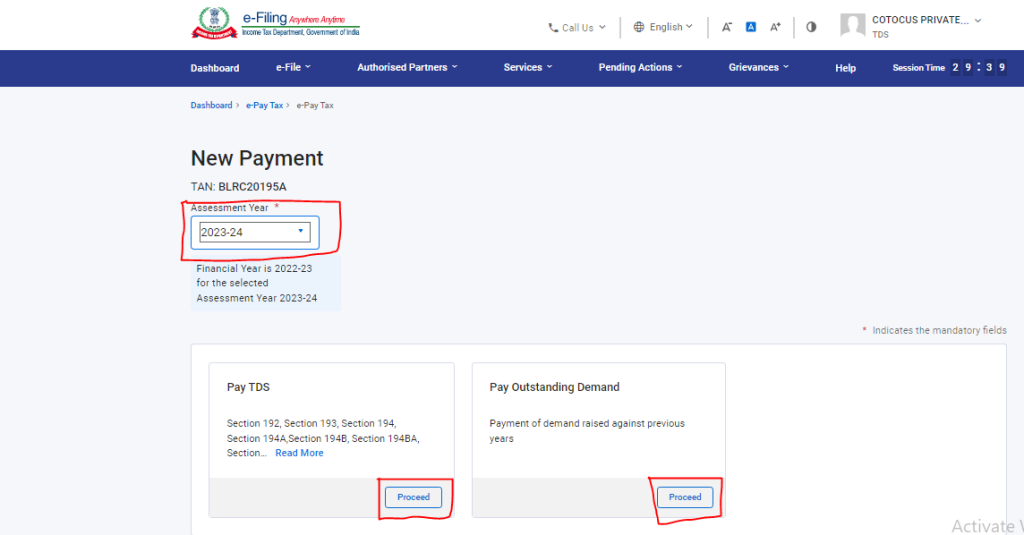

- After clicking on it, please select the assessment year, if you are paying the TDS then please click on the Pay TDS option, and If you have any demand for the TDS then please click on the Pay Outstanding Demand button.

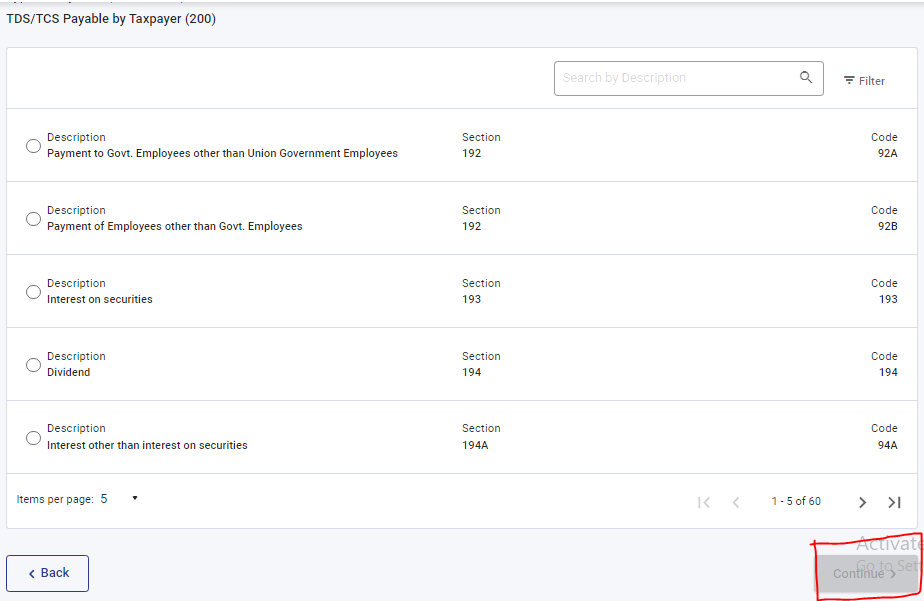

- Now select your TDS payment section and click on the continue button.

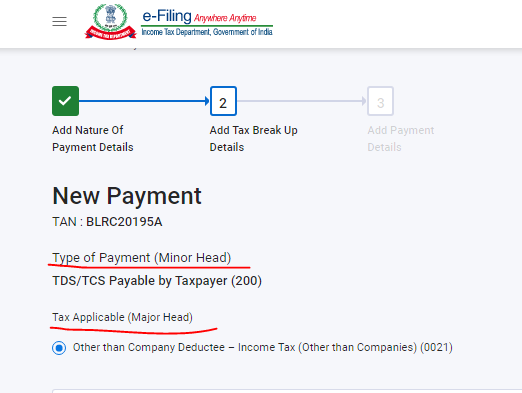

- Note Point – Please see your Type of Payment (Minor Head) and Tax Applicable (Major Head).

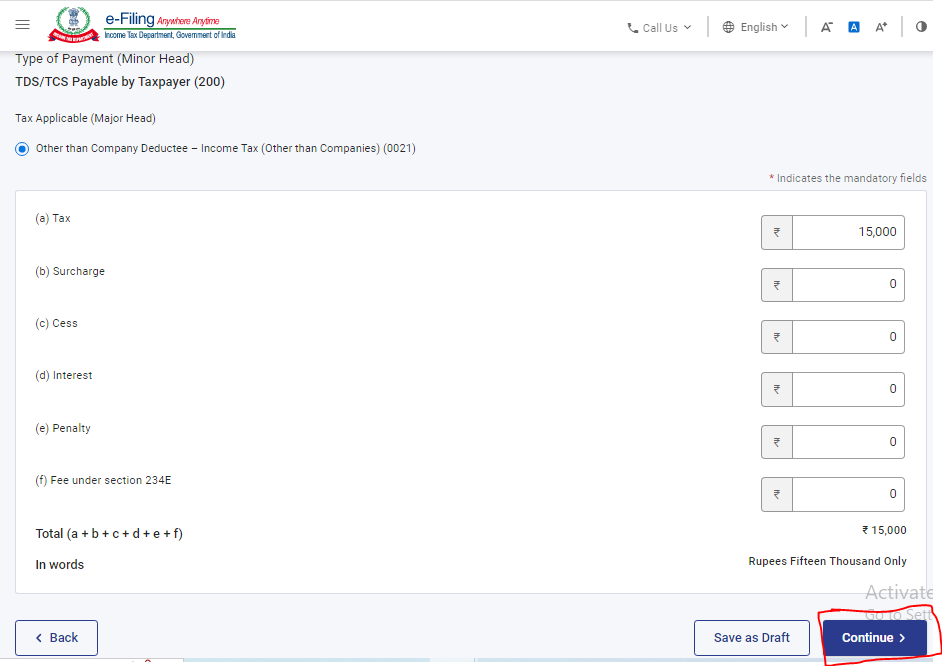

- After that, please enter your TDS amount and click on the continue button.

- please select your bank because of this you can pay your TDS amount.

- After that, you can pay your TDS amount easily.

NOTE POINT

- If you think that you will be paid your TDS in the next few hours, you can save your data by clicking on the Draft button.

Thanks