Greetings

This is Ravi Verma, In this Article, I will show you how to download the CSI file from the income tax portal.

Let’s Begin

What is the importance of a CSI file for the TDS return filling?

The CSI file is the most important part of the TDS return filing process because after we have paid our TDS liabilities per month wise then it is important to know what is the payment amount, date, section, payment type, etc. All these things are available in the CSI file, and because of this, the CSI file acts as a date and payment management agent when we file our TDS return.

That’s why the CSI file is the most important part of the TDS return process.

Steps to download the CSI file

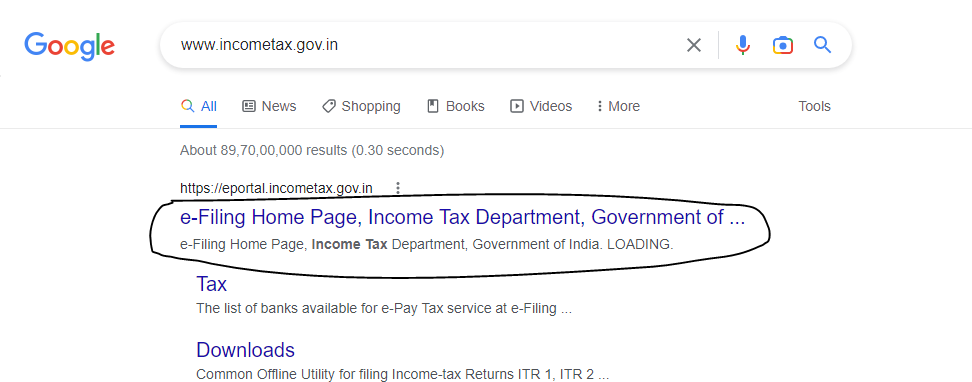

- Go to your web browser and open it.

- Search Incometax.gov.in and click on the enter button after that click on the 1st heading option of the income tax page.

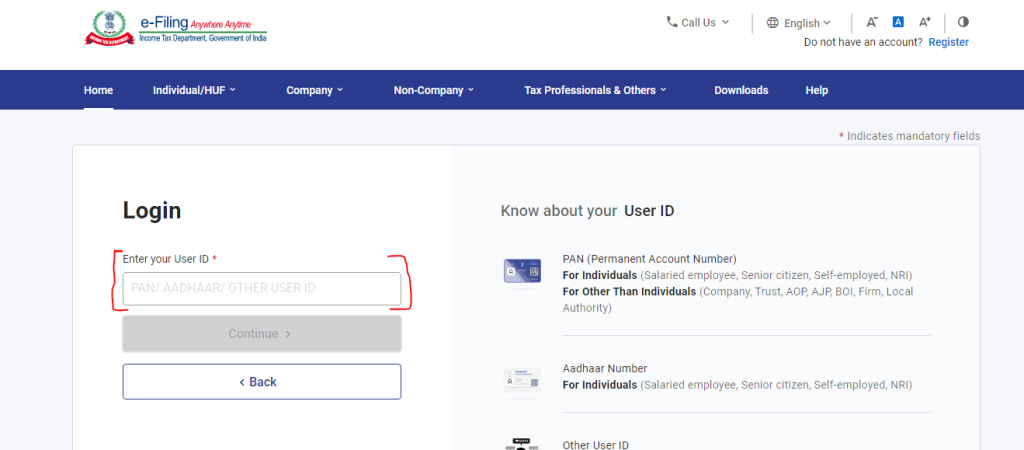

- After that, you have to enter your login ID i.e your TAN number and password in the given field.

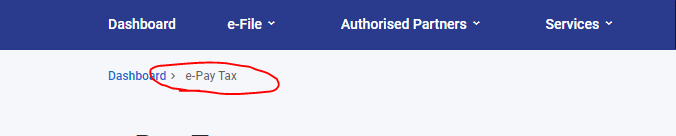

- After that, go to the e-file option.

- Under the e-file option, you will see the e-pay tax option then click on it.

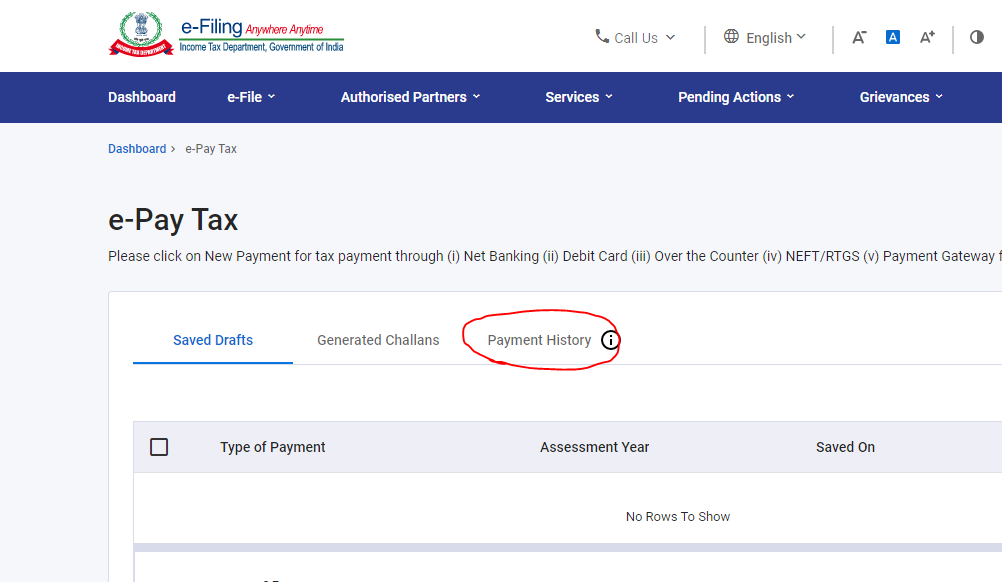

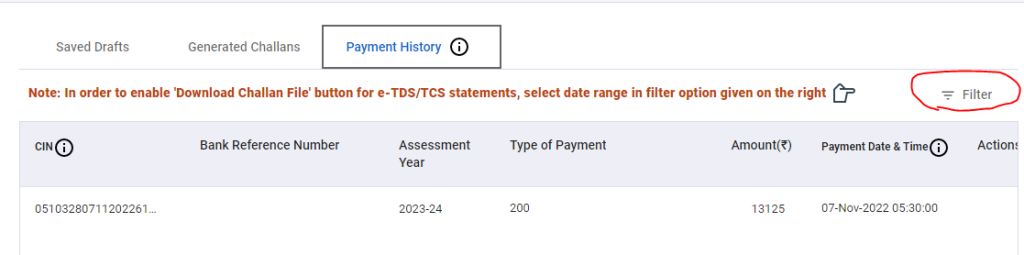

- After that, click on the payment history option.

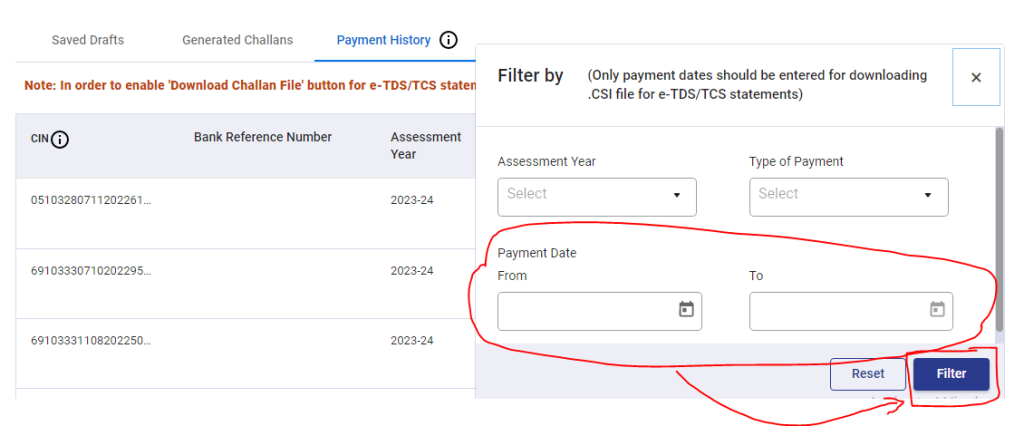

- Click on the filter button and select your quarter’s payment date.

- Only select the date nothing select the other option, after doing this step click on the filter button.

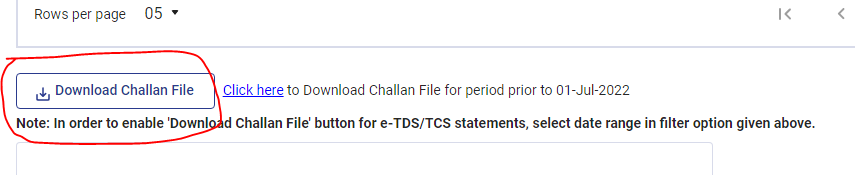

- After selecting your payment do scroll down, here you will be given the option to download the challan file, then click on this button.

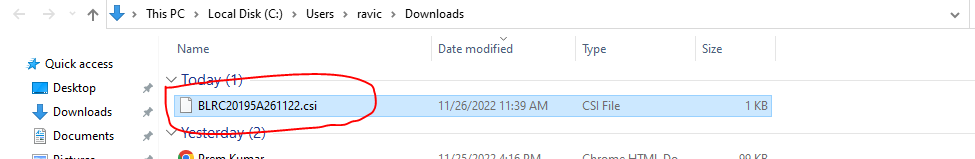

- After doing these steps your CSI file has been downloaded to your desktop.

Thanks,