Hi Everyone!

In my today’s article, I will let you know about section 194C

What is the TDS section 194C?

Section 194C of the Income Tax Act, of 1961 deals with Tax Deducted at Source (TDS) on payments made to resident contractors. It talks about TDS, which stands for Tax Deducted at Source. Now, this TDS applies to payments made to contractors who live in the country.

Here are the main points: –

Who’s included? Any contractor who does work (including providing labor) for the government, local authorities, certain corporations, companies, or cooperative societies.

What payments are we talking about? Money is given for different types of jobs like work contracts, advertising, broadcasting, transportation of goods or passengers, and supplying labor.

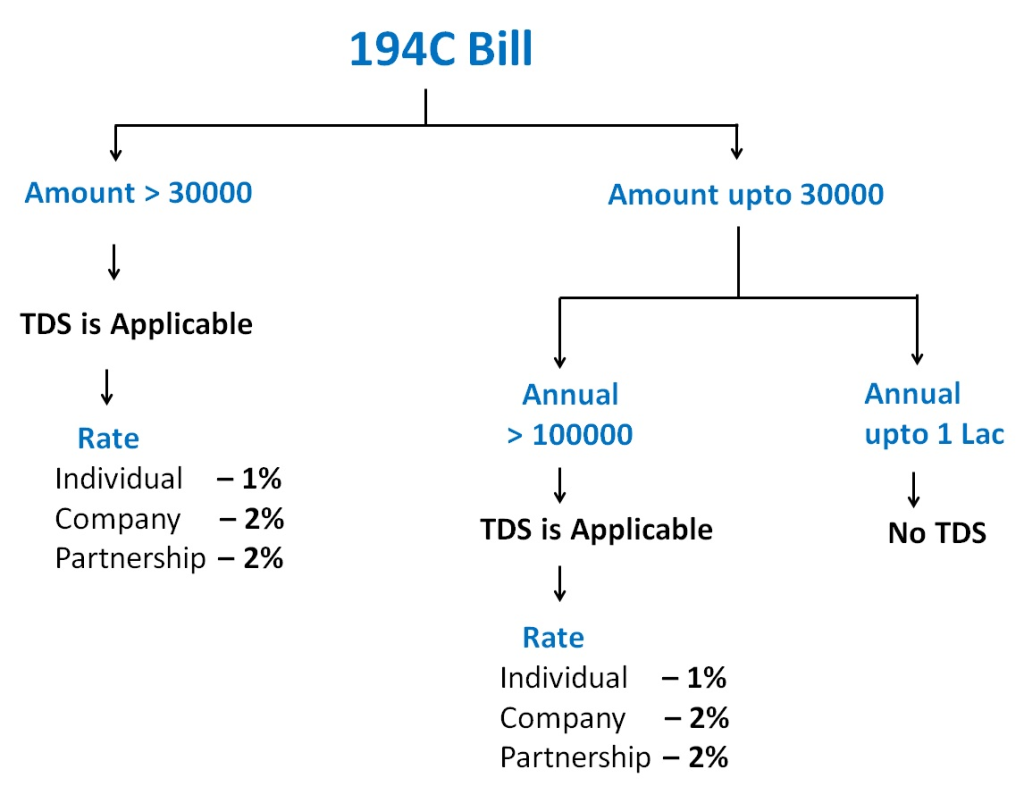

How much the tax needs to be deducted? If you’re an individual or part of a family (HUF), you deduct 1% before paying. If you’re some other kind of entity, it’s 2%.

Are there any exceptions? Yes, if the payment is less than ₹29,000, you’re off the hook. But if you pay more than ₹31,000 in a year, you can’t escape. Also, if you’re just paying for personal stuff or if the tax officer says it’s okay, you might not have to deduct any tax.

What is the Rate of TDS?

| Nature of Payment | TDS Rate with PAN available | TDS Rate without PAN |

|---|---|---|

| Payment/Credit to resident individual or HUF | 1% | 20% |

| Payment/Credit to any resident person other than individual/HUF | 2% | 20% |

| Payment/Credit to Non-Resident Contractors | 20% | 20% |

| Payment/Credit to Transporters (only for goods carriage) | NIL | 5% |

When does TDS under Section 194C need to be deducted?

TDS under Section 194C needs to be deducted at the time of credit of the amount to the account of the contractor or at the time of payment, whichever is earlier. So, if you credit the contractor’s account or actually pay them, you should deduct the applicable TDS at that moment. This ensures that the tax is deducted at the source, right when the payment is being made or credited.

Who is required to deduct TDS u/s 194C?

A specified person here means:

- Central or State Government

- Local Authority

- Corporation

- Company

- Co-operative Society

- Trust

- University

- Registered Society under the Societies Registration Act

- HUF/AOP/BOI

- Firm

What is the meaning of contractor and subcontractor?

Under Section 194C of the Income Tax Act, the terms “contractor” and “subcontractor” have specific meanings:

Contractor:

- A person who agrees to do a job for the government, companies, or similar groups and gets paid for it.

- The job could be anything from building things to advertising or providing professional services.

Subcontractor:

- A person who agrees to do part of the job for the main contractor, not directly for the big groups.

- They might do some of the work or provide workers for the job.

Now, here’s a simple table:

| What they do | Contractor | Subcontractor |

|---|---|---|

| Who they work with | Government, companies, etc. | Main contractor |

| Type of work | Does the main job | Does part of the main job or provides workers |

| How they get paid | Directly from the group they work for | From the main contractor |

| When tax is deducted | If paid more than ₹30,000 or ₹1 lakh overall | If paid more than ₹30,000 or ₹1 lakh overall, and the main contractor deducts tax under section 194C |

Key points to remember:

- Both contractors and subcontractors can be regular people, companies, or other kinds of groups.

- The tax deduction rule (TDS) only applies if they’re getting paid by groups within India.

- If the subcontractor gets paid directly by the main contractor, they might still have tax deducted if the main contractor already did that under Section 194C.

Thanks!

[…] https://www.stocksmantra.in/section-194c-tds-on-payment-to-contractors/ […]