Hi everyone,

In my today’s blog, I will let you know, how to record expense accounts on Zoho Books.

Expense?

An expense is the money a business spends on regular stuff to keep running. It includes things like rent, salaries, and supplies. To see if a business is making or losing money, you take these expenses away from what it earns. So, an expense is just the cost of doing business.

an expense is basically a cost that a business has to pay to make money. These costs can cover a bunch of things –

- Cost of Goods Sold (COGS): This is the cost of making the stuff a company sells, like buying materials and paying workers.

- Operating Expenses (OPEX): These are the everyday costs of running a business, such as rent, salaries, and advertising.

- Administrative Expenses: These are costs for managing the business, like office supplies, paying office staff, and office rent.

- Selling Expenses: These are costs linked to selling products, such as advertising, sales commissions, and travel for salespeople.

- Interest Expense: This is the cost of borrowing money, like paying interest on loans.

- Depreciation and Amortization: This is like spreading out the cost of big things, such as buildings or equipment, over time.

In simple terms, expenses are what you subtract from the money a business makes to figure out if it’s making a profit or not.

The formula is

Profit = Revenue−Expenses.

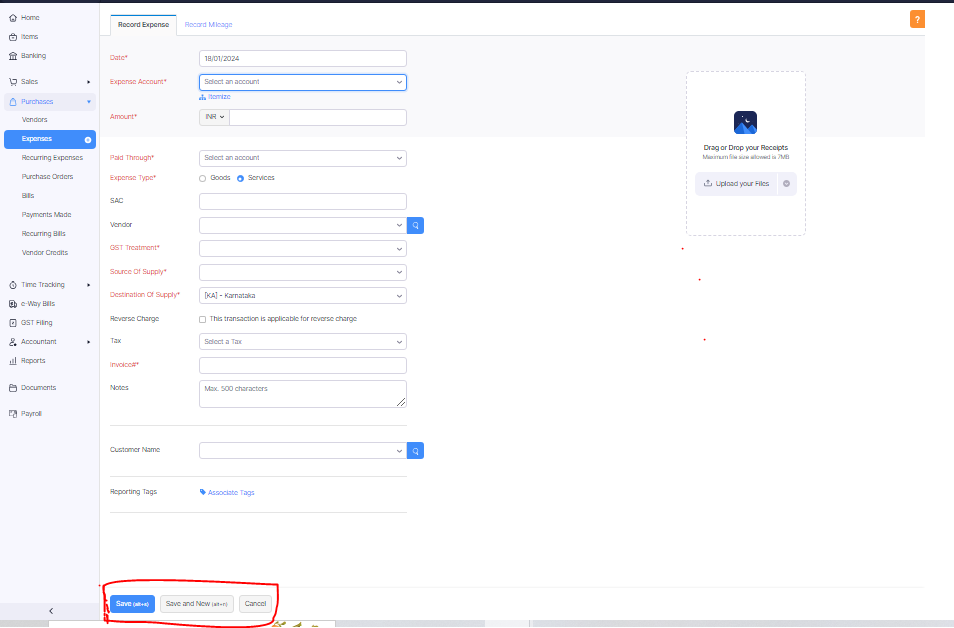

How to record an expense account on Zoho?

Here I am giving you all the steps of how to enter expenses on Zoho.

a. Go to Zoho Books and log in.

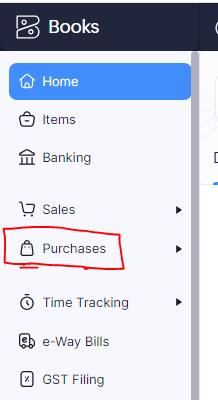

b. Click on the “purchase button”

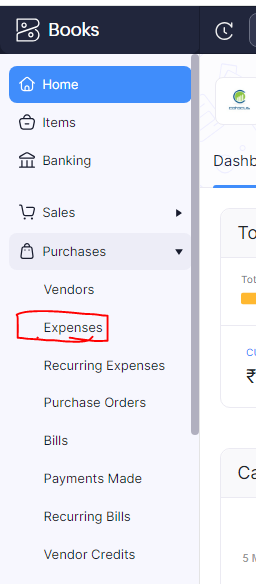

c. Look for the “Expenses” section under the purchase.

d. Click on “Add New” or a + button.

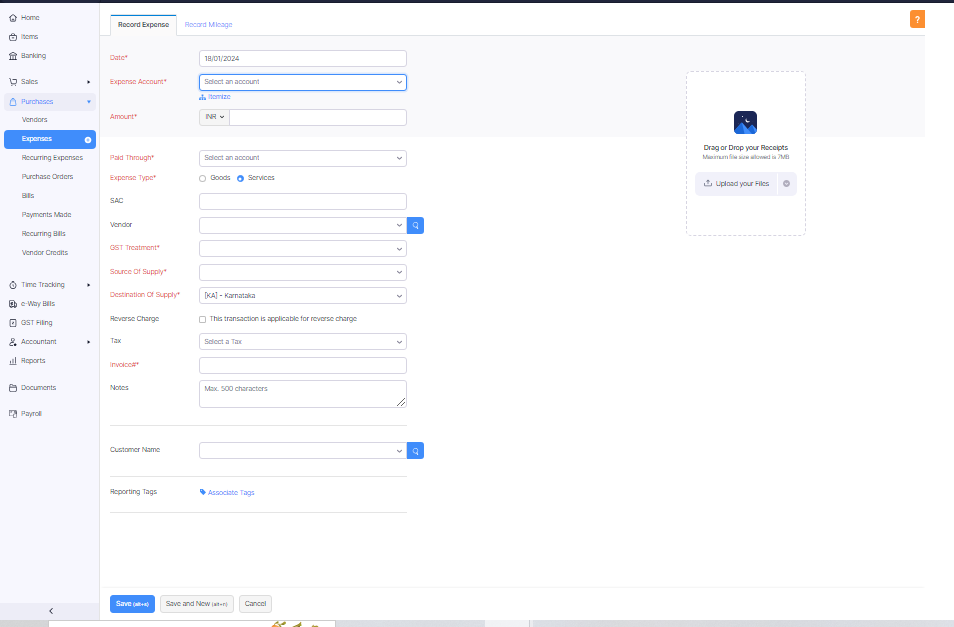

e. Put in the date, who you paid, type of expense, amount, taxes, and all the required details in the given column.

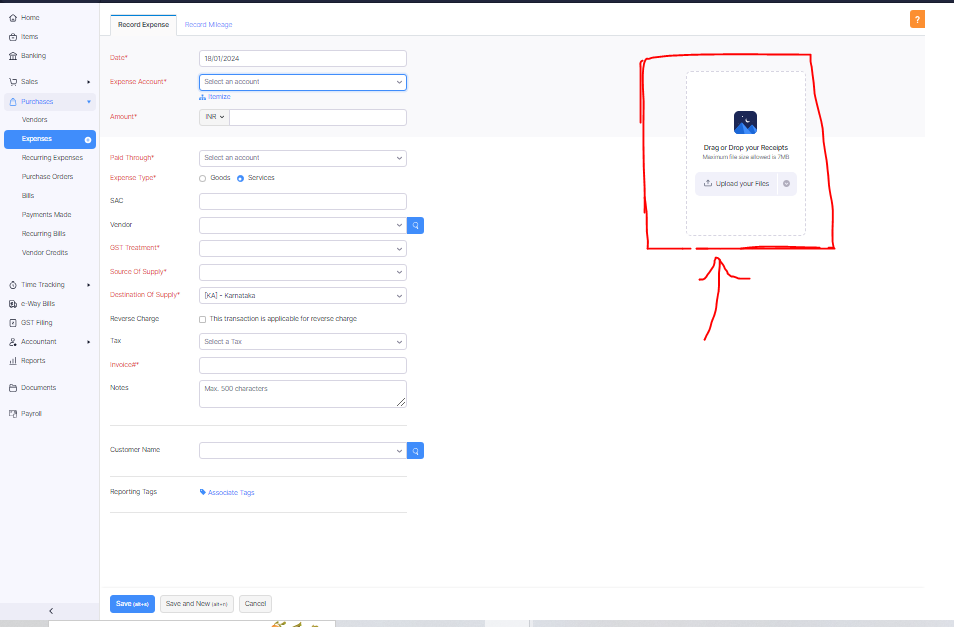

f. But don’t forget to attach the receipts.

g. And last click on the “save button” and please verify the details once.

Thanks,