Hey all,

In this blog, I will you know how to check the ITR refund status Online.

What is INCOME TAX?

Income tax is a direct tax levied by the government on the income earned by individuals, businesses, and other entities within its jurisdiction. There are many sources to collect Income tax from every taxable body because the government has already announced that income tax is a direct tax and the government has already defined that if you cross your exemption limit at any time you would have to pay the tax because you are eligible to pay the tax and you have crossed your exemption limit in your category.

The government has collected this tax because they are trying to improve public services, including education, healthcare, infrastructure development, and various other programs that’s why.

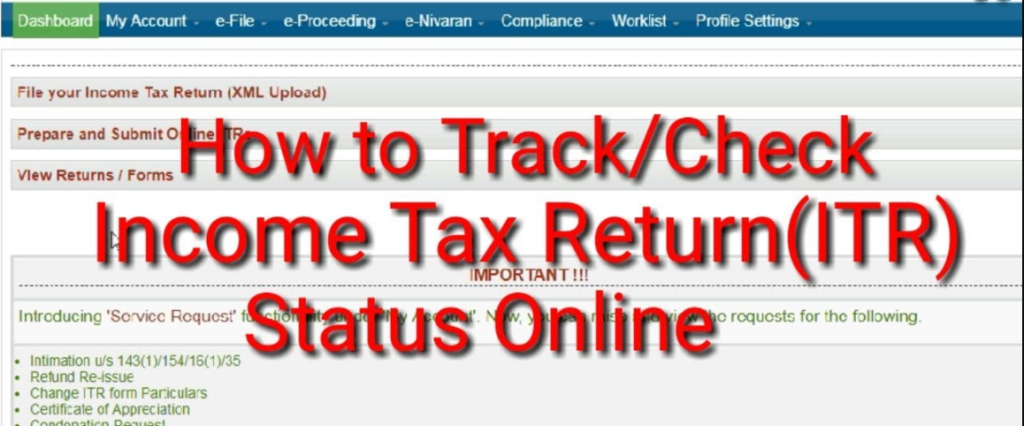

The checking process of Income Tax refund status online?

If you have paid more than taxes of your actual liabilities, you can claim your excess amount by raising a request letter to the Income tax department the Tax department will verify your request letter and they will match your record from his report after that they will give you your refund.

There is a simple process to know about your refund status.

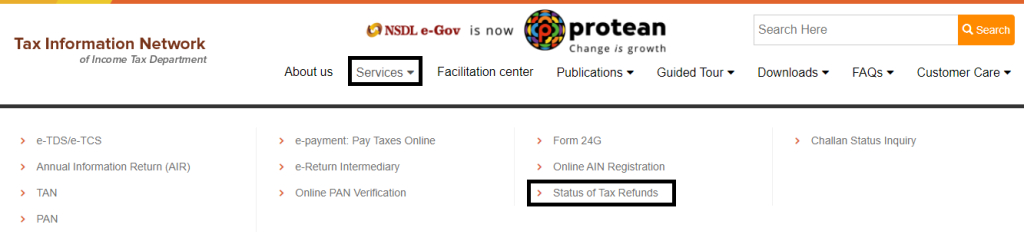

Step1. Please open your browser and search Tin NSDL.

Step2. Click on the 1st link.

Step3. After that, you will enter the NSDL dashboard so what do you have to do? click on the services tab and in this you can see the status of the tax refunds button click on it.

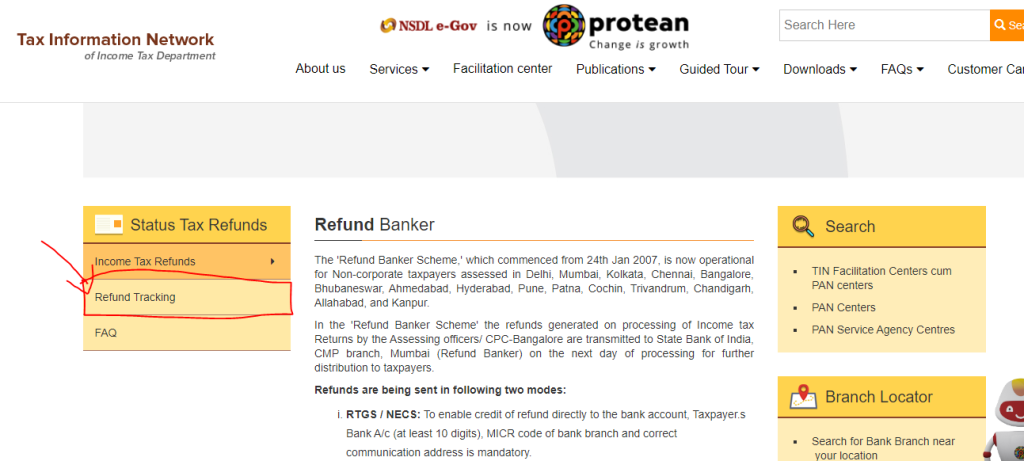

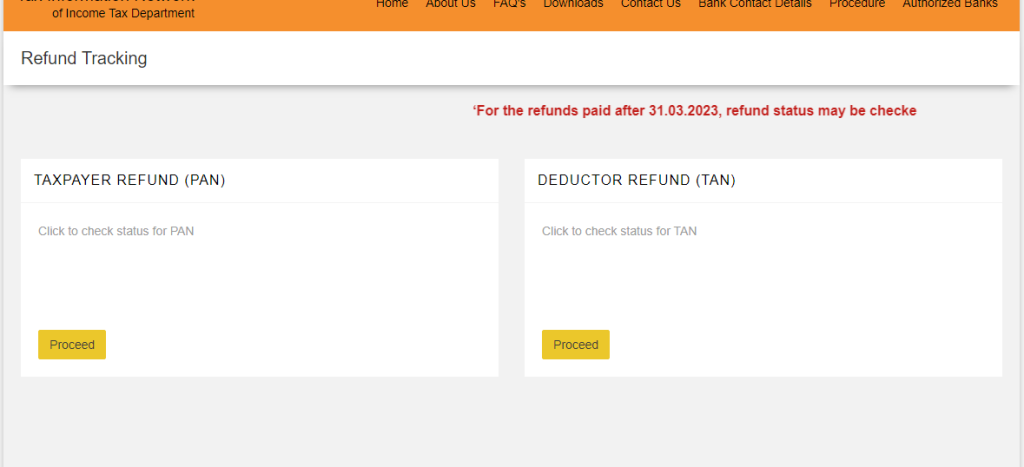

Step4. After clicking on the “status of the tax refund” button you will see the dashboard of the REFUND STATUS so please click on the refund tracking option because that button will help you to do the next process.

Step5. In this interface you have to select your category if you are deducting the TDS then you have to choose the “DEDUCTOR REFUND (TAN)” and if your TDS has been deducted by the employer then you have to choose the “TAXPAYER REFUND (PAN)” Option.

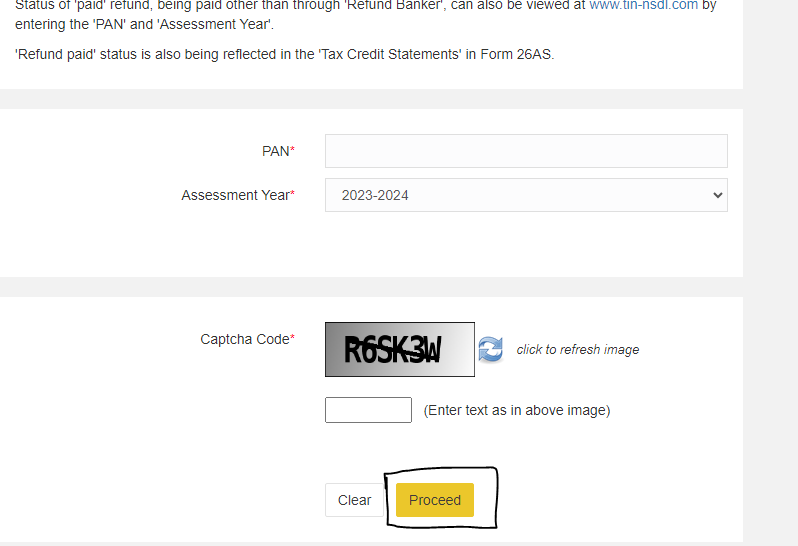

Step6. After clicking on the Proceed button please enter your PAN number & select the assessment year after that fill in the captcha code and click on the Proceed button.

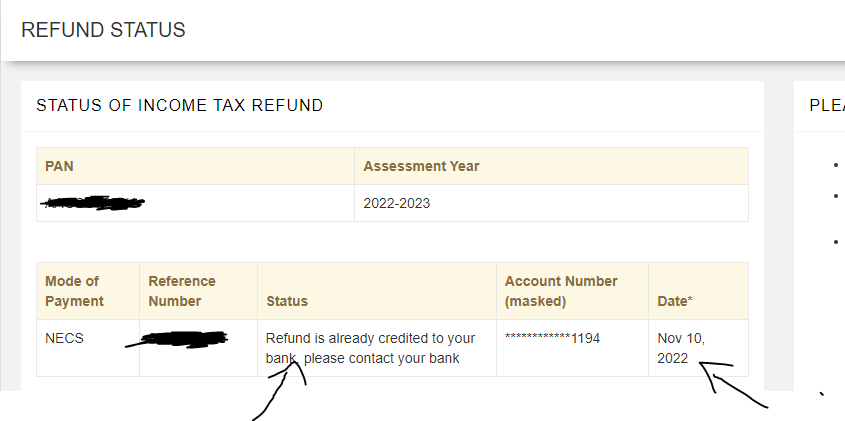

Step7. After clicking on the Proceed button, you can see the status of your refund If your refund proceeds then you will receive the refund process message on your dashboard,

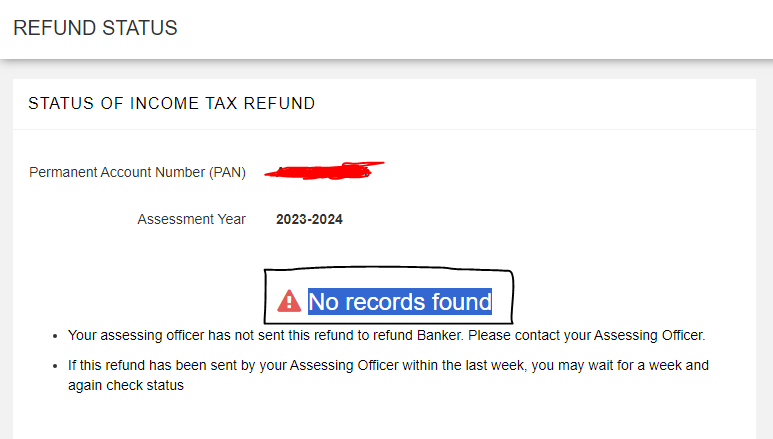

Step8. And If your refund is pending then you will receive a No Records Found message on your Dashboard.

Thanks,