Hey Guys,

Today, we will discuss with you how to file ITR-6 in an offline way.

What is ITR-6?

ITR-6, short for Income Tax Return Form-6, is a crucial document filed by companies in India, excluding those eligible for exemption under section 11 of the Income Tax Act, 1961. Companies falling under section 11 are those with income from property held for charitable or religious purposes.

This form necessitates companies to disclose various financial aspects, including:

- Income Sources: Details about income from business or profession, as well as income from other sources like capital gains, interest, and dividends.

- Deductions and Exemptions: Companies must report deductions claimed and exemptions availed.

- Taxes Paid: Comprehensive information about taxes paid during the financial year is mandatory.

Moreover, ITR-6 requires companies to furnish data regarding their directors, shareholders, and other key personnel.

For the financial year 2022-23, the deadline for filing ITR-6 is July 31, 2023. It is strongly advised for companies to submit their returns well before the due date to evade late filing penalties.

Key Features of ITR-6:

- Comprehensive Reporting: ITR-6 mandates companies to divulge all financial details comprehensively.

- Applicability: All companies registered under the Companies Act, 2013, or the earlier Companies Act, 1956, are required to file ITR-6, except those eligible for section 11 exemptions.

- Filing Deadline: The last date for filing ITR-6 for the financial year 2022-23 is July 31, 2023.

Companies have the option to file ITR-6 either online or offline. Online filing can be done via the Income Tax Department’s e-filing portal, whereas offline filing involves downloading the ITR-6 form from the Income Tax Department’s website and submitting it manually.

Given the complexity of ITR-6, companies are strongly encouraged to seek professional assistance from qualified chartered accountants or tax consultants to ensure accurate and timely filing.

Who should file ITR-6?

ITR-6 is the Income Tax Return form that should be filed by all companies registered under the Companies Act, 2013, or the earlier Companies Act, 1956, except for those companies claiming exemption under section 11 of the Income Tax Act, 1961. Companies that fall under section 11 are those whose income from property is held for charitable or religious purposes.

Here are examples of companies that should file ITR-6:

- Private limited companies

- Public limited companies

- One person companies

- Limited liability partnerships (LLPs)

- Foreign companies with a permanent establishment in India

It’s important to note that companies are required to file ITR-6 even if they have not made any profit or loss during the financial year. If there is any uncertainty about whether a company should file ITR-6, it is advisable to seek guidance from a qualified chartered accountant or tax consultant to ensure compliance with the tax regulations.

ITR-06 Filing steps

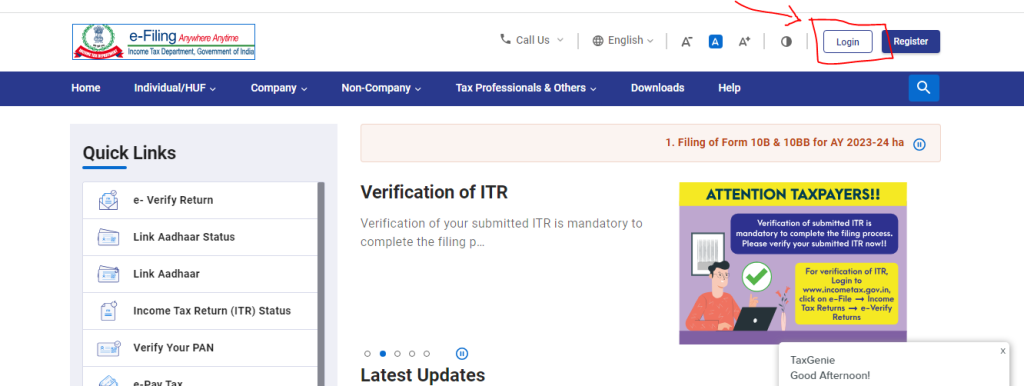

Step1. Login to the Income Tax portal by using your ID and Password.

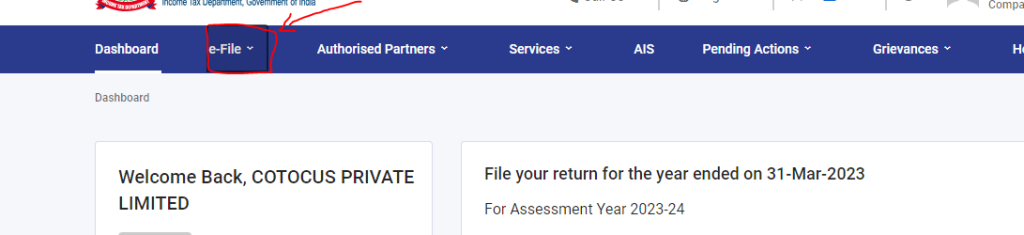

Step2. After logging into your Income Tax portal. Please click on the file button.

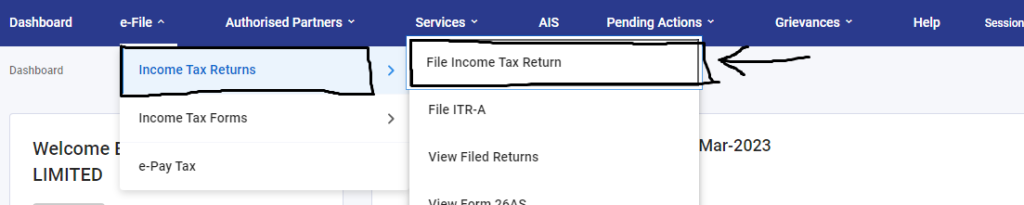

Step3. Under the e-file button, you will see the Income tax return option, and after clicking on the income tax returns option you have to click on the File Income Tax Return option.

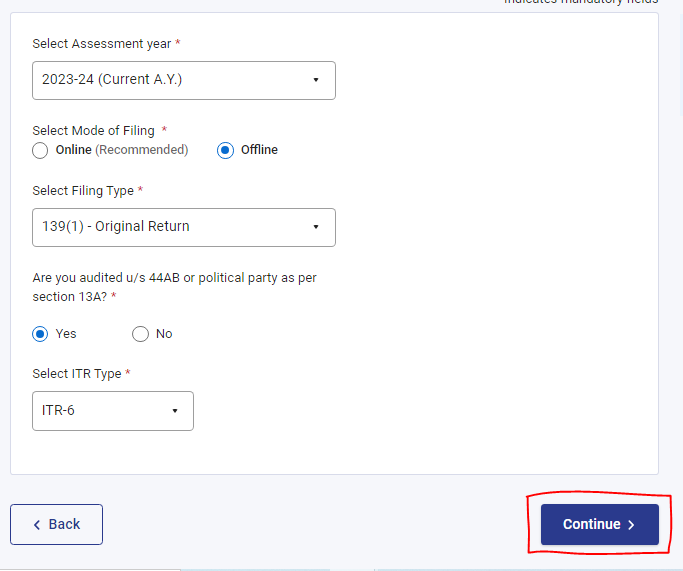

Step4. After that, Please select your required details according to your return and then click on the continue button.

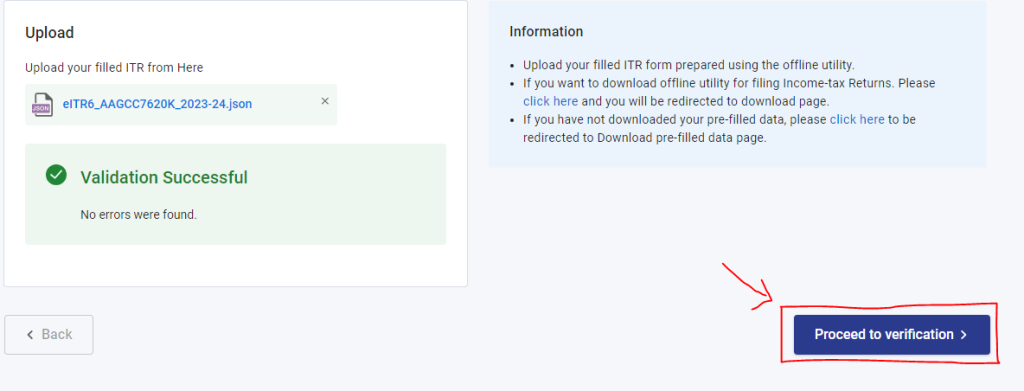

Step5. After that click on the file attach button. after the validation of your file please click on the proceed to validation button.

Step6. And the last one is please attach your DSC and file your return.

Thanks,