Hey All,

In this tutorial, I will let you know the steps to amend credit and debit notes in a simple way.

Let’s begin,

If you made a mistake in credit and debit notes by entering any of the columns, then don’t worry, and be ready to correct your mistake in just a simple way.

Here are the steps to do the correction on credit and debit notes.

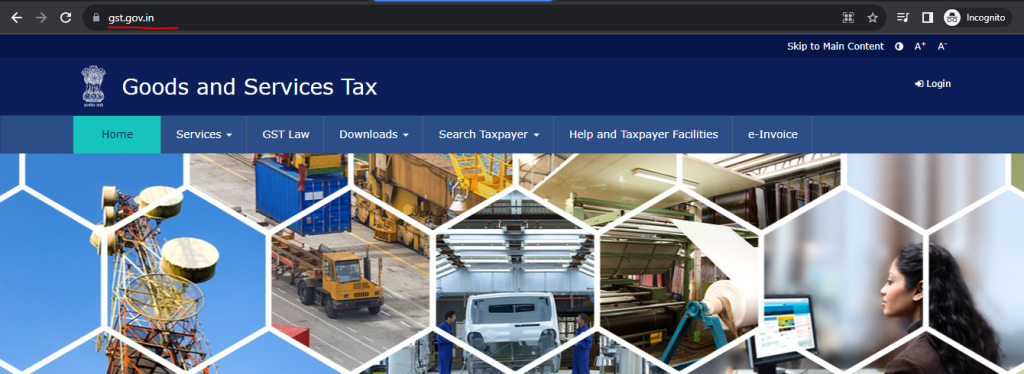

Step1. Please go to the GST portal through this link – https://www.gst.gov.in/

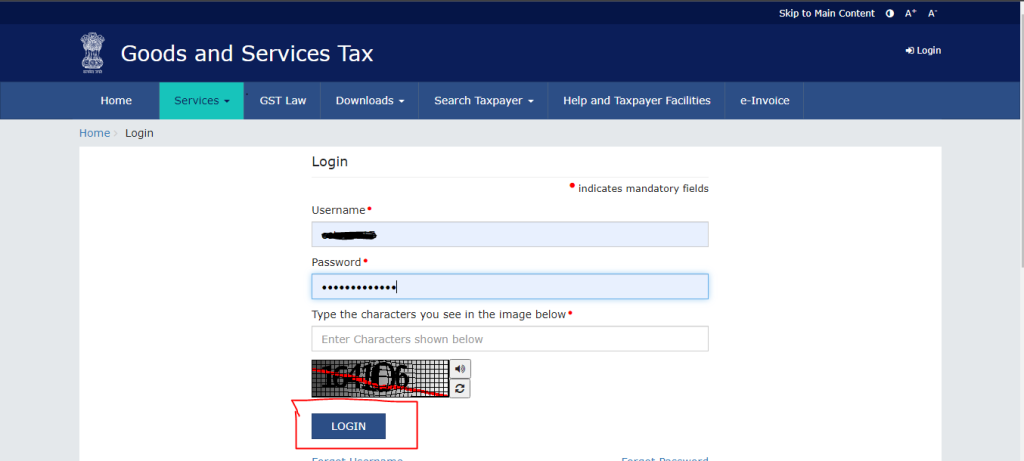

Step2. Login to the GST portal by entering your correct ID and Password.

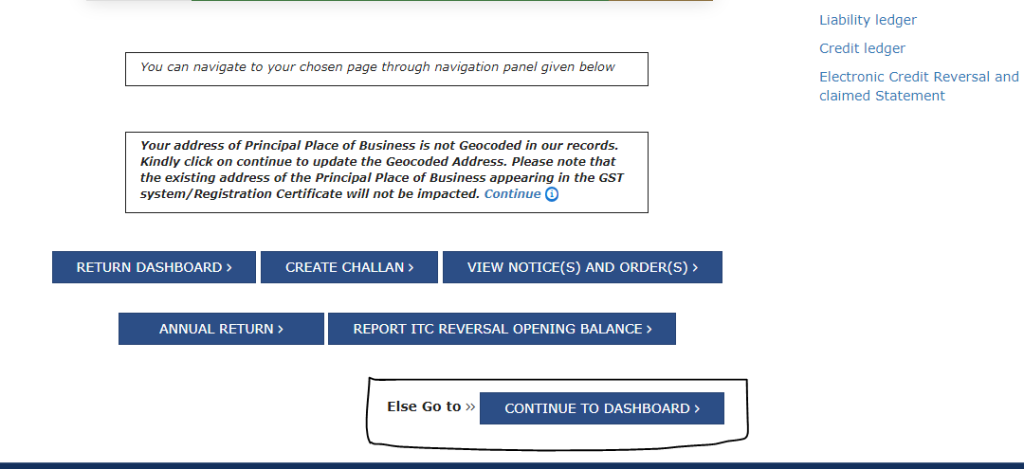

Step3. After that, please click on the Continue to Dashboard button.

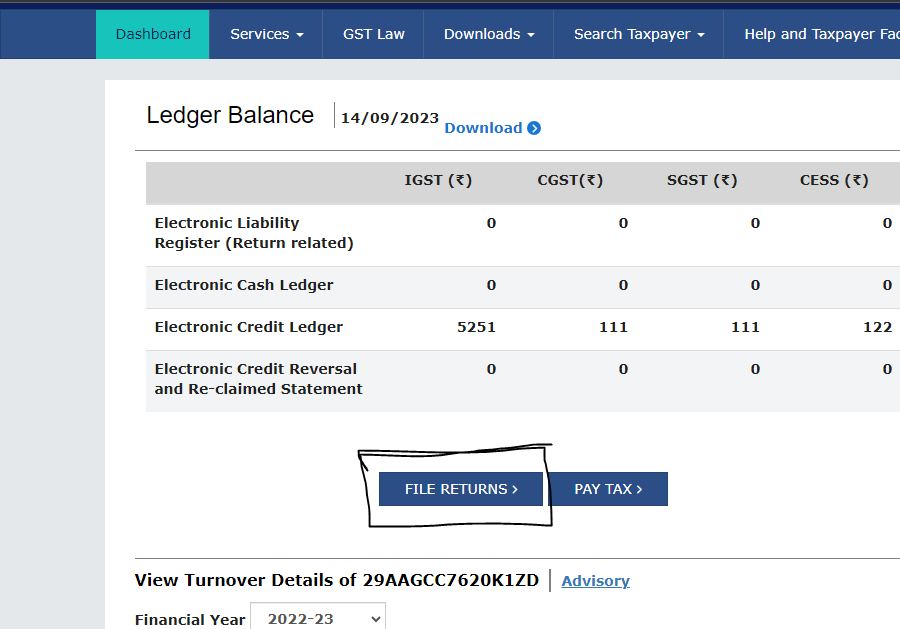

Step4. Please click on the file returns button.

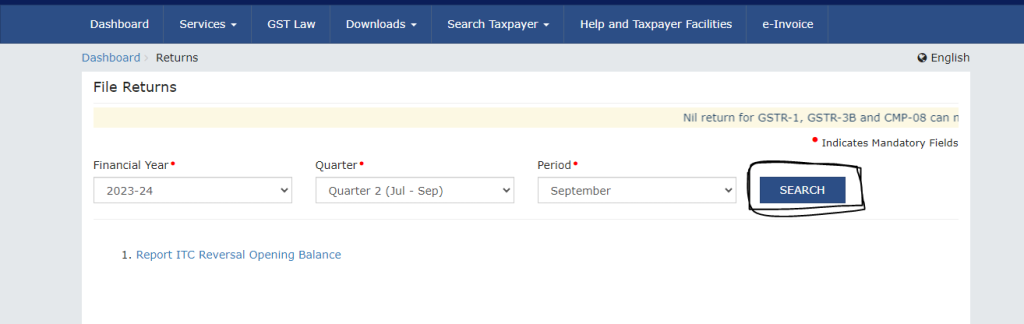

Step5. Select your period and click on the search button.

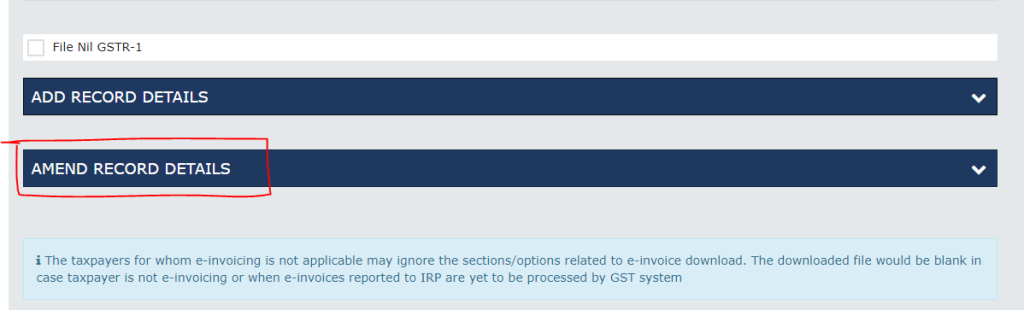

Step6. After clicking on the search button, please click on the amend record details button.

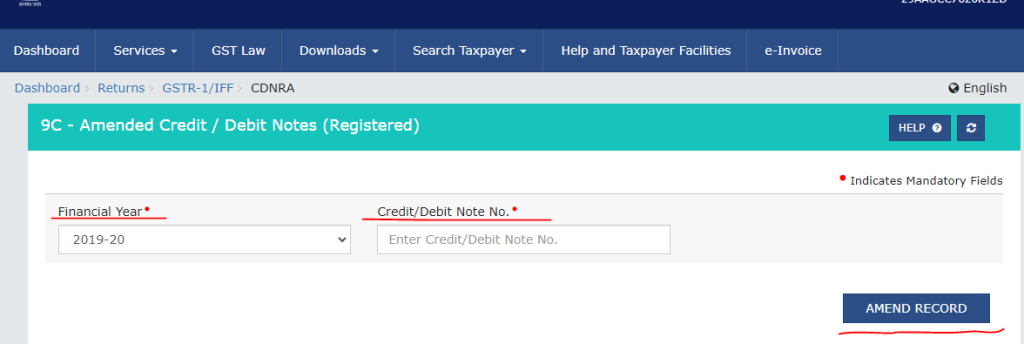

Step7. After that, you can see the amended column number – 9C of the registered person. then please click on it.

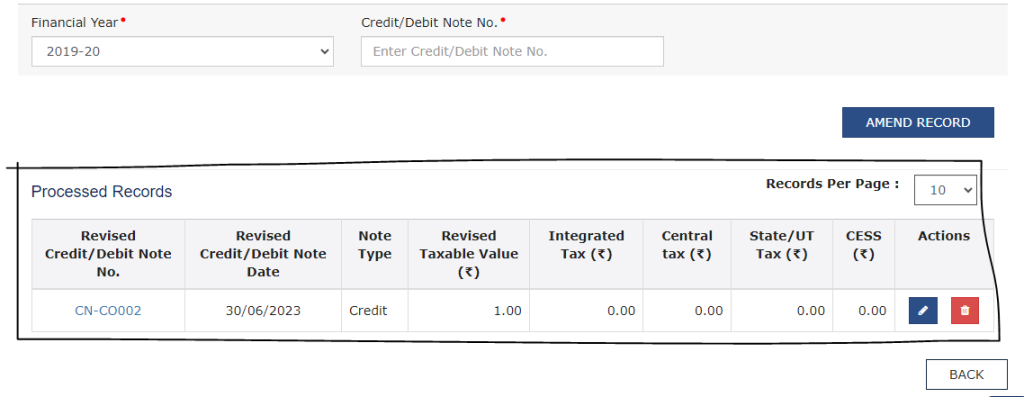

Step8. Then please select the financial year and enter your credit/debit note number lastly please click on the amend record button.

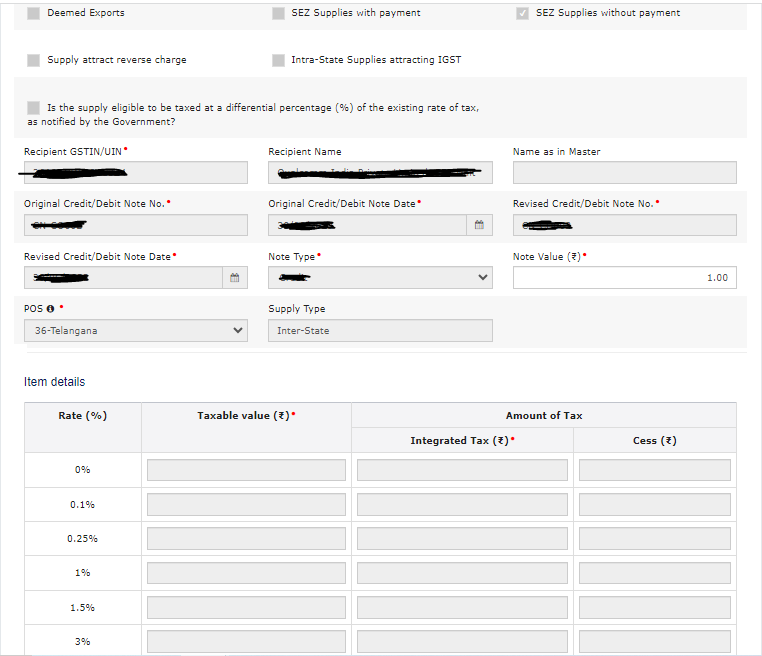

Step9. After that, Please enter all the details into the given column & select the note type and click on the save button.

Step10. After completing all these steps your credit note will be amended.

Thanks,