Provident Fund (PF) is a retirement savings scheme that is compulsory for most employees in India. It is a government-managed scheme, and both the employee and employer contribute a fixed percentage of the employee’s salary to the PF account. The money in the PF account is invested by the EPFO (Employee Provident Fund Organisation) and earns a fixed rate of interest.

Here’s how PF works:

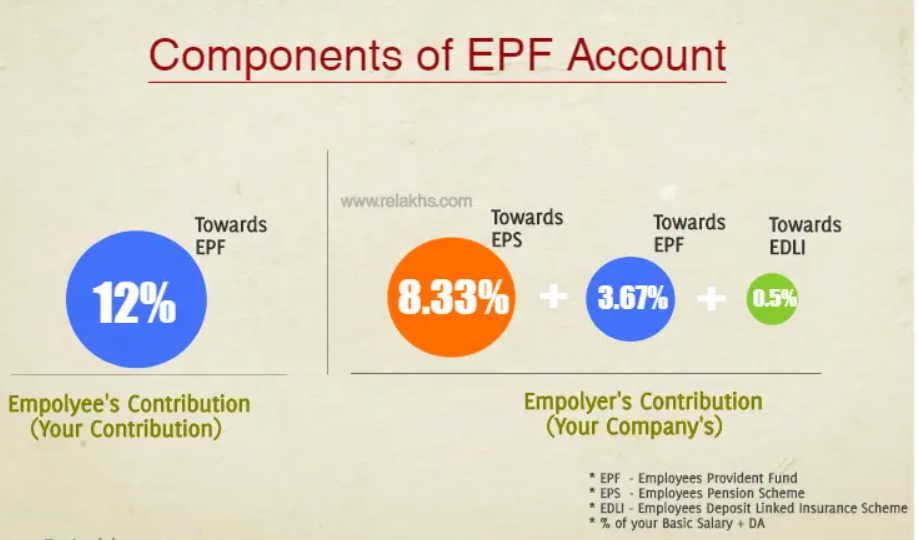

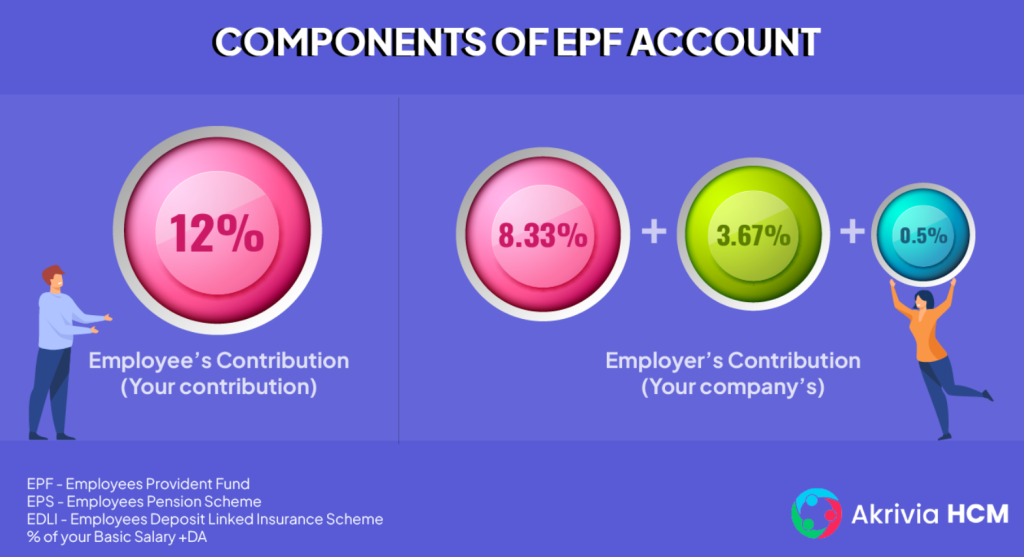

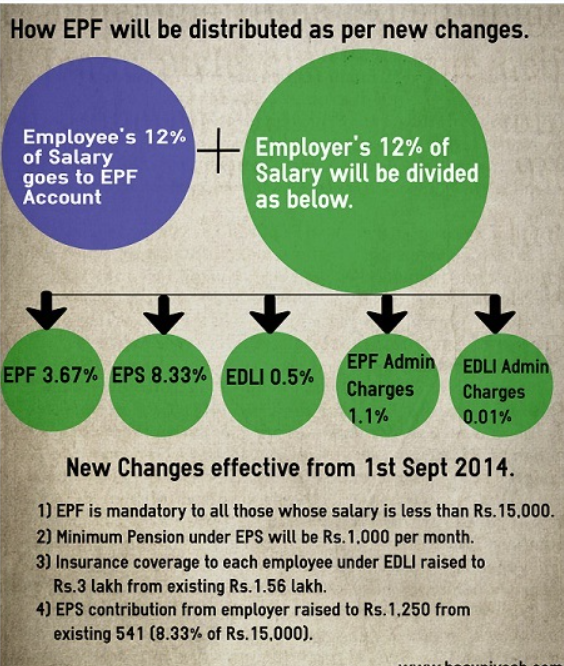

- The employee and employer contribute a fixed percentage of the employee’s salary to the PF account. The contribution rate is 12% of the basic salary for employees working in organizations with 20 or more employees. For employees working in organizations with less than 20 employees, the contribution rate is 10% of the basic salary.

- The money in the PF account is invested by the EPFO in a variety of securities, including government bonds, treasury bills, and corporate bonds.

- The PF account earns a fixed rate of interest, which is set by the government every quarter. The current interest rate for PF is 8.5% per annum.

- The employee can withdraw money from the PF account after retirement, or under certain other circumstances, such as:

- Leaving the job

- Marriage

- Purchase of a house

- Medical emergencies

- The PF account is a tax-saving scheme, and the interest earned on the PF account is also tax-free.

PF is a valuable retirement savings scheme, and it is a good way to save for your future. The money in the PF account is invested by the EPFO and earns a fixed rate of interest, which means that your money will grow over time. You can also withdraw money from the PF account under certain circumstances, which makes it a flexible savings scheme.

Here are some of the benefits of PF:

- It is a compulsory savings scheme, so you don’t have to worry about saving for retirement.

- The money in the PF account is invested by the EPFO and earns a fixed rate of interest, which means that your money will grow over time.

- You can withdraw money from the PF account under certain circumstances, such as retirement, leaving the job, or medical emergencies.

- The PF account is a tax-saving scheme, and the interest earned on the PF account is also tax-free.

If you are an employee in India, you should definitely consider contributing to the PF scheme. It is a valuable retirement savings scheme that can help you secure your financial future.