Hello guy’s

This is Ravi Verma, In this article, I will tell you about the GTA service

Let’s start

The Indian ministry department has Implemented a new guideline under the GTA service taxpayers.

From 18th July 2022 onward if you take any service from GTA then you have to pay 5% GST in your Taxable supplies. The government has removed the previous GST exemption i.e 750rs and 1500rs.

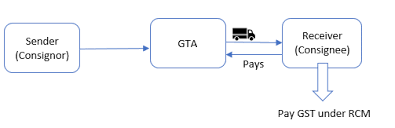

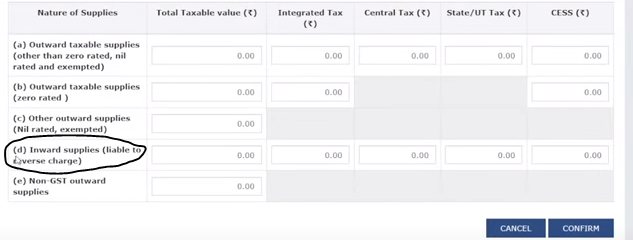

If you avail of any service from the GTA then you will have to pay 5% GST in your taxable amount. due to this amendment, we will have to pay the GST amount in the GSTR-3B, under Table number 3.1 Tax on outward and reverse charge inward supplies, in column number D Inward supplies (liable to reverse charge)

Now From 18th July 2022 if you have any Invoices for your GTA service then you can furnish your GTA invoice by adding a 5% GST rate.

Thanks