Hello Guy’s

This is Ravi Verma, In This Article, I would tell you about Quarterly ITC.

Let’s start,

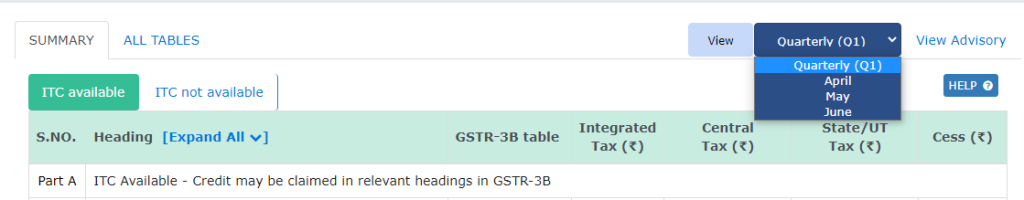

That is a very simple way to find Quarterly GSTR-2B in our GST portal. Under this table, we can see our Quarterly ITC monthly wise.

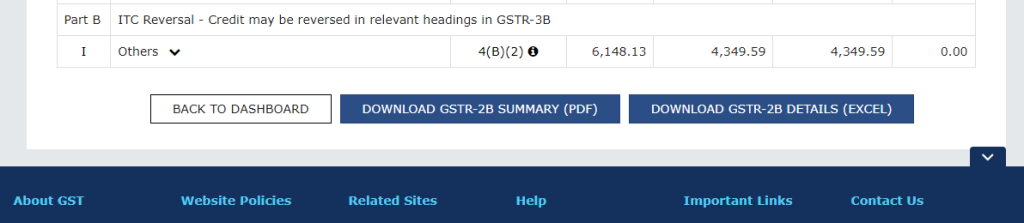

We would know what is the month wise ITC which we can avail. we would know what is our eligible ITC and what is our uneligible ITC with the help of the quarterly GSTR-2B table.

The government helps us a lot to know the amount of our ITC.

Steps to know how to see quarterly GSTR-2B.

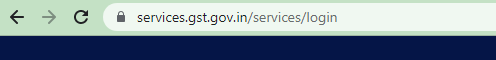

- Goto to your browser and enter GST.

- After that put in your User ID, Password, and Captcha code as well, and now click on the login button.

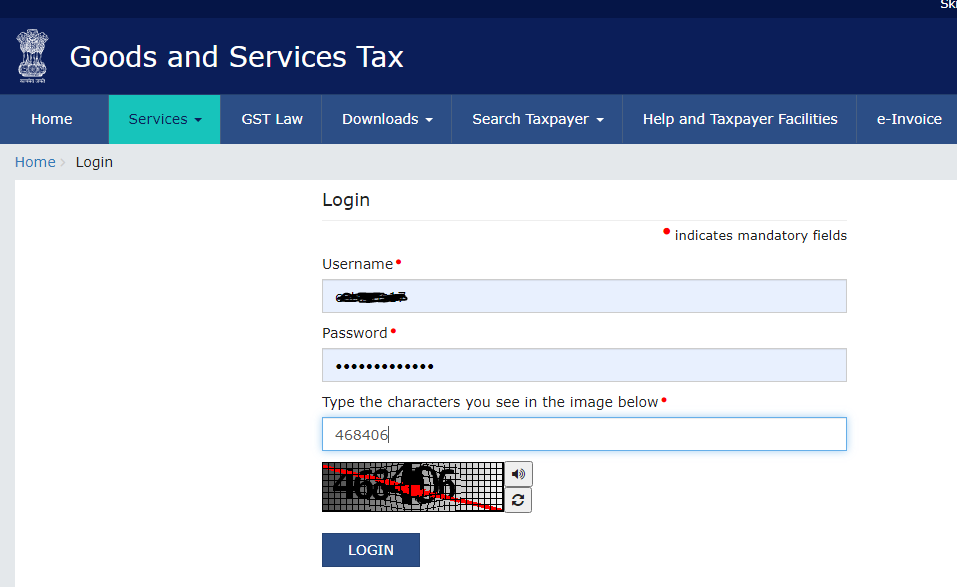

- After that click on the Continue to dashboard button.

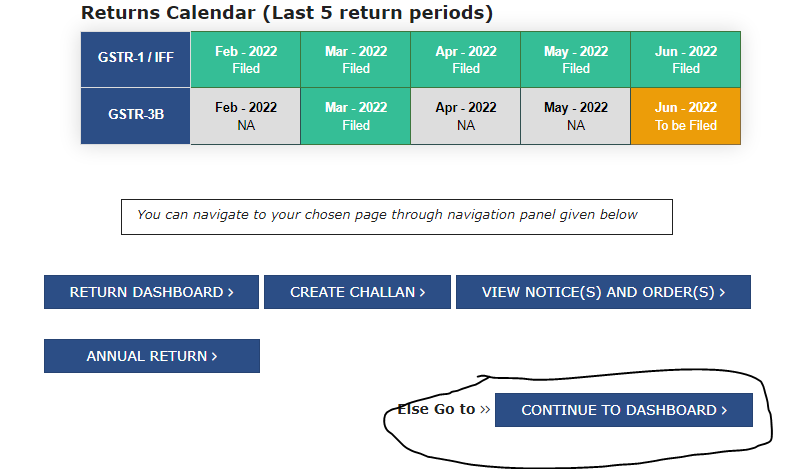

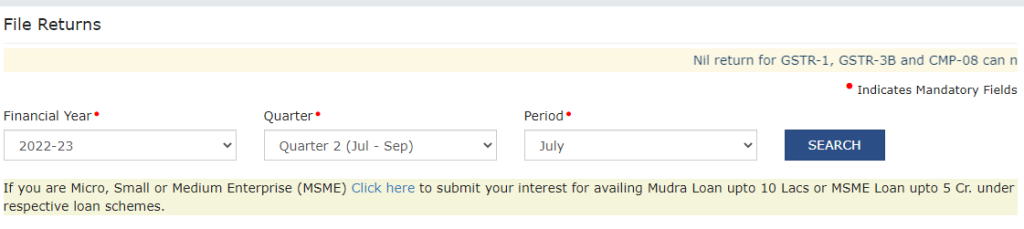

- Now Click on the File return Button.

- After that select your period, year, and quarter.

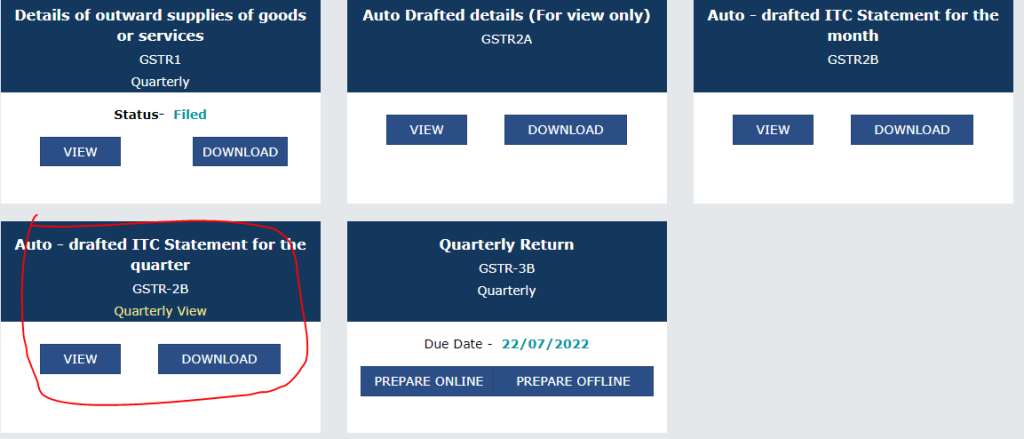

- Do scroll down and click on the GSTR-2B Quarterly table.

- Under this Table, you can see easily your all ITC Amount accordingly month-wise.

- And you can also download the summary in PDF and Excel format.

Thanks