Hi Guys,

This is Ravi Verma, in this article I will tell you about the late fee and interest of GSTR-3B.

Lets Start,

As per the GSTR rules, when a company does not file GSTR-3B by its due date, interest and late fees are levied on the company.

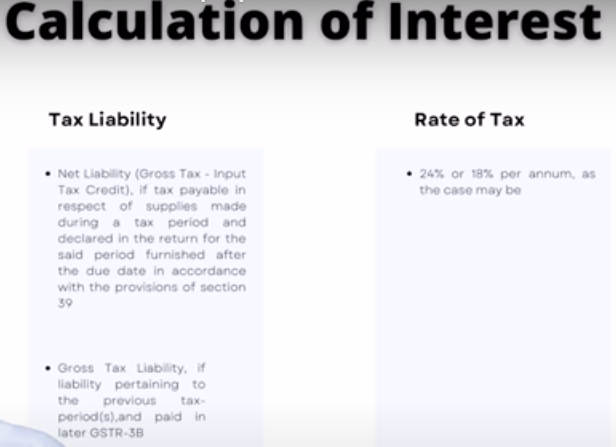

- Calculation of Interest.

Under GSTR-3B, we can calculate our interest as follows,

Case 1:- If we pay tax for January month after the due date of February, then we have to calculate interest according to net liabilities.

***Net Liabilities = Gross liability Tax – ITC = Net Liability

Example – If our tax amount for the month of January is Rs 1,00,000 (Tax 120000 – ITC 20000 = Net tax 100000) and our due date is February 22, suppose we pay the tax with a delay of 5 days, then the interest is calculated in the net liability Basic.

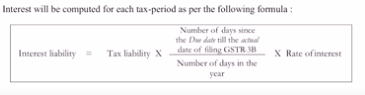

Formula:- (Total tax – total ITC)Net Tax *18%*day / year(365) = Interest amt.

Case 2:- If we pay tax for the month of January after the month of February, then we have to calculate the interest as per the gross liabilities.

Example – If our tax amount for the month of January is Rs 1,20,000 (without ITC claim) and our due date is February 22, suppose we pay the tax with a delay of 1 month i.e March, then the interest is calculated in the gross liability Basic.

Formula:- (120000) Gross Tax *18%*day(08+31=39) / year(365) = Interest amt.

Note point *** If you are paying your taxes in the same period, the interest tax rate will be 18% and the tax will be calculated as the basic salary of the net liability.

If you do not pay your taxes in the same period, pay the tax next month then we calculate the gross liability payment tax and the tax rate is 18%.

Case3:- If we claim excess ITC for the payment of tax then the interest rate will increase by 24% p.a.

Formula:- 120000*24%*day / 365 = total interest

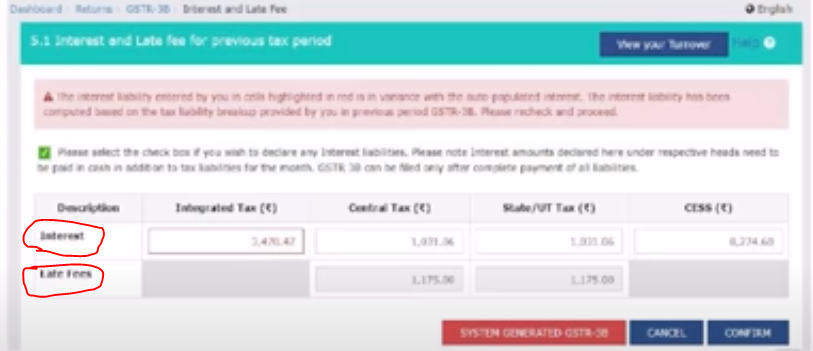

Calculation of late?

Date of Filing – Due date of Filing * 25Rs = Total late fees.

In case of NIL liability

Date of Filing – Due date of Filing * 10Rs = Total late fees.

Thanks,