Any business which had a turnover was fewer than 5 lakhs was sent to the column in the QRMP Scheme, whereby we used to furnish the invoices of all our B2B sales with the help of the invoice furnishing facility to all our B2B sales.

But now the GST portal has been changed from 1st-April-2021. In which, from now on, all our sales, whether they are B2B or B2C, we have to enter the column of GSTR-1.

NOTE****** Important point

- If we have equipped all our B2B invoices in the month of January and February with the help of the invoice Furnishing facility, then we will not have to file them in GSTR-1

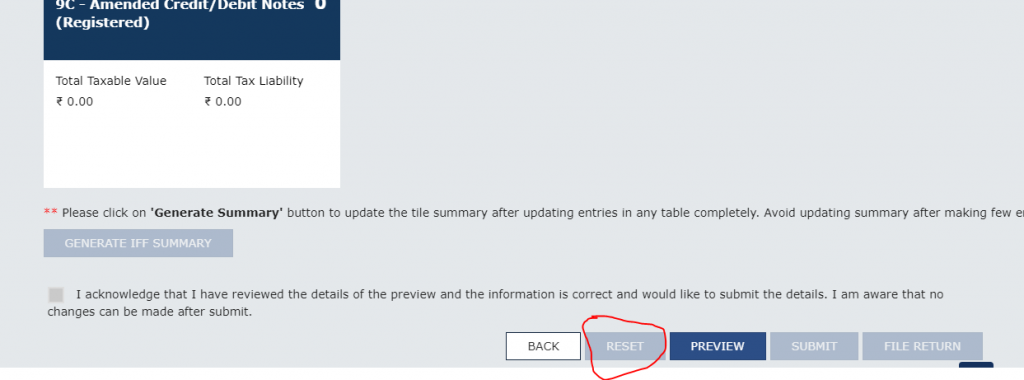

- If we have submitted all our B2B invoices with the help of the Invoice Furnishing Facility method, but it has not been filed, then we have to delete all those data in the GST portal under the QRMP scheme. Otherwise, it can bring problems for us in subsequent returns.

- We have to file our sales Invoices in the quarterly mode in GSTR-1

How To Delete unfiled IFF data under QRMP scheme

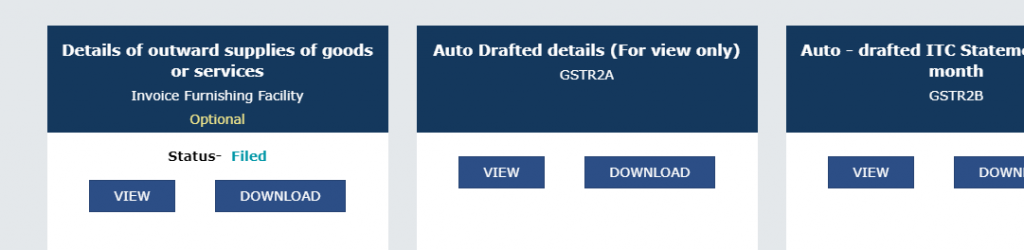

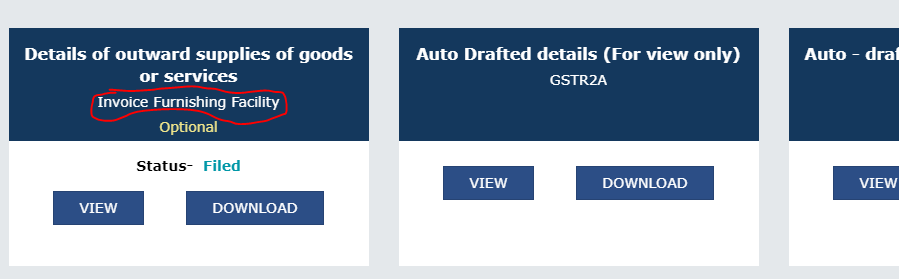

Step 1st>>>>> Open Your GST portal>>>>>Select Period (January & February)

Step 2>>>> Click IFF icon

Step 3 >>>>> Open your IFF Column Go to Scroll Down and Click Reset button

You can delete your old Data if you do not file your B2B invoices in the IFF facility under QRMP Scheme