Can I avail the QRMP scheme at any point of time during a financial year?

According to the Indian government, we cannot avail of quarterly Return monthly payments in any financial year. For this, the government has given a date for everyone, according to which we can take advantage of this QRMP scheme.

| QRMP YEAR | OPT-IN AND OPT-OUT DATE |

| APR-MAY-JUNE(2021) 1st Quarter | MARCH 1st to APRIL 31st |

| JULY-AUG-SEPT(2021) 2nd Quarter | MAY 1st to JULY 31st |

| OCT-NOV-DEC (2021) 3rd Quarter | AUG 1st to OCT 31st |

| JAN-FEB-MARCH(2022) 4th Quarter | NOV 1st to JAN 31st |

I have opted for QRMP Scheme, Does it require to file GSTR-1 on quarterly basis?

If we have opted for a quarterly return monthly payment option then we have to make our (GSTR-1) tax payment monthly so that our vendor or supplier does not have any problems in getting his income tax credit. For this, we can use the invoice furnishing facility (IFF) and pay tax our taxes.

What is IFF facility under QRMP scheme?

When the annual turnover of a company is up to 5 crores, then that company can opt for the quarterly Return monthly payment scheme, in this scheme we have been told by the government that you have to pay tax in the monthly mode. For this, the government has given us a new feature, which we call the invoice furnishing facility, With the help of this facility, we can furnish our all business to business invoices. So that there is no problem for our supplier or vendor to get his income tax credit.

How do I require to make payment of GST under QRMP scheme?

In the quarterly Return monthly payment scheme, we can do the payment of goods and service tax by the ChallanPMT06.

This is how we can fill this challan

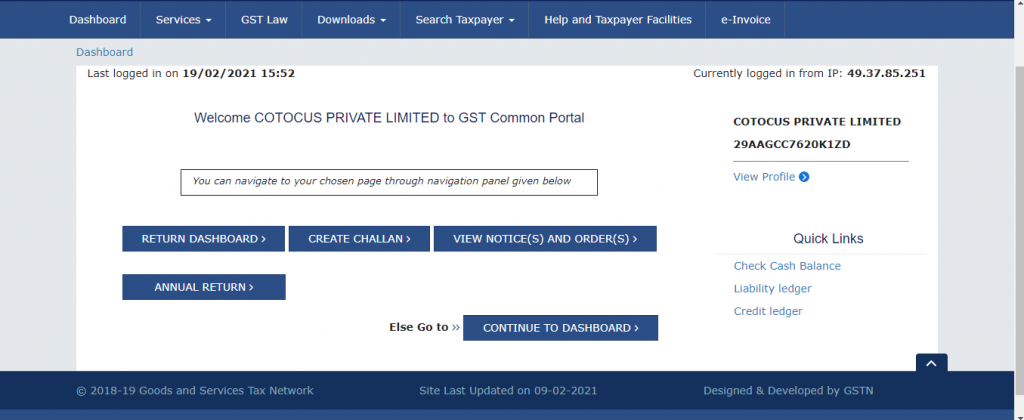

Step 1 . Login our GST Portal >>>> Go To Return Dashboard

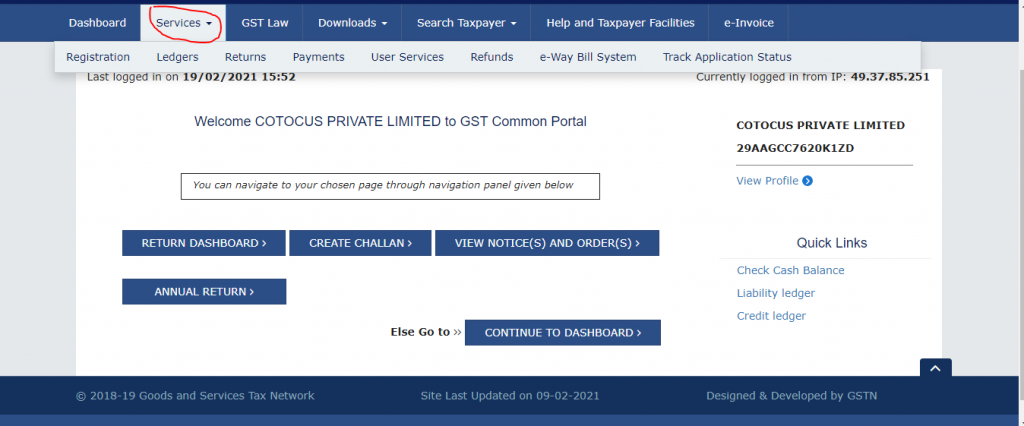

Step 2 . Click to the Services option .

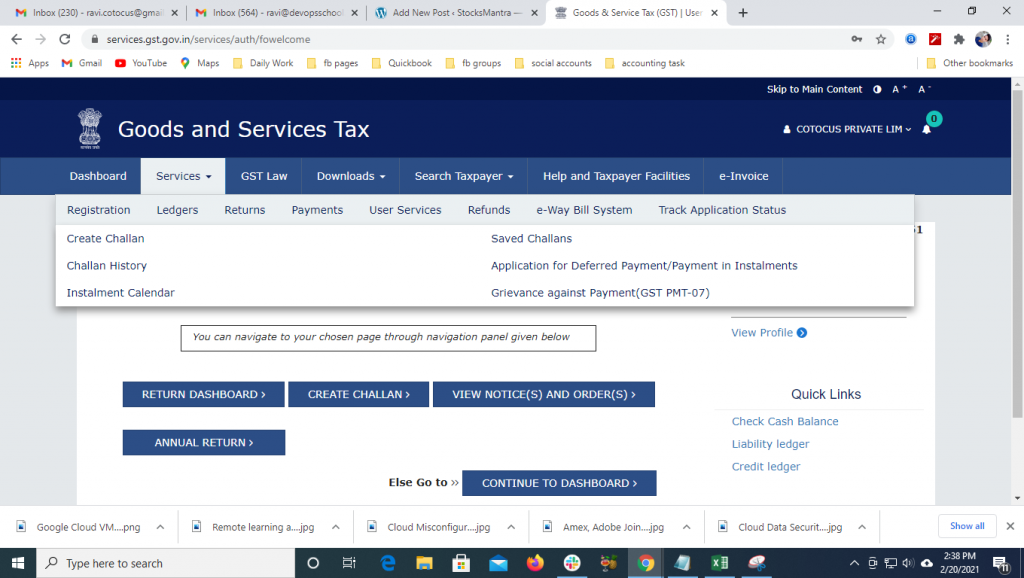

Step 4 . Go to payment option >>>>> And Click to the Challan icon

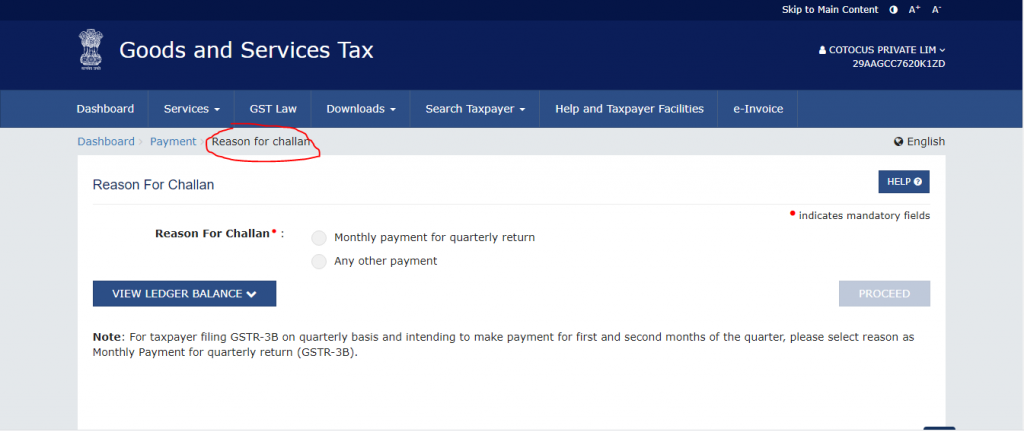

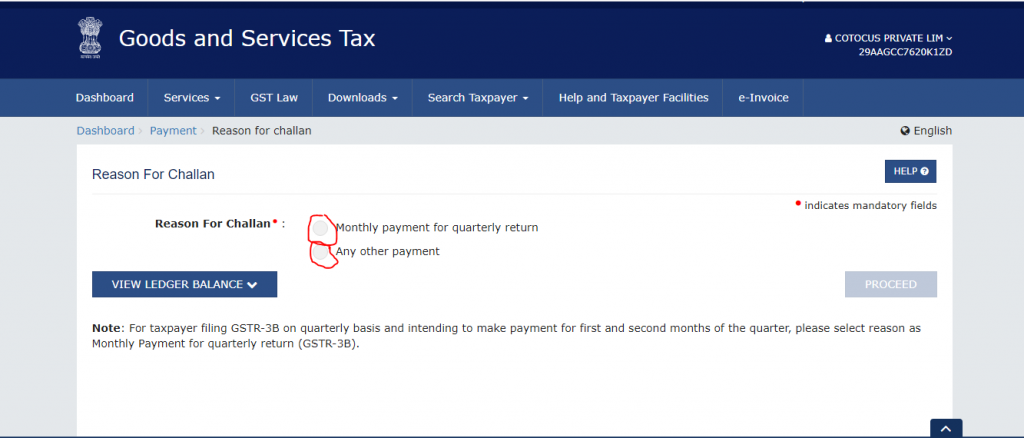

Step 5. Select Reason For Challan

Step 6. There Are two options on our Screen (a) Monthly payment for Quarterly return and (B) any Other Payment. In this, we have to select an (a)option Monthly payment for Quarterly return

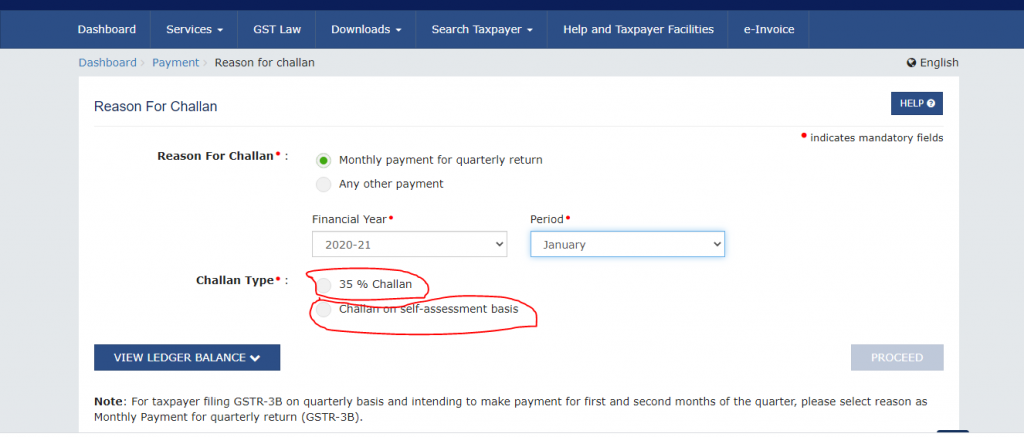

Step 7 . There are Two Option in our screen by Select challan type (a)35% Challan- This means that we have to pay tax according to 35%and (b) Challan on Self-Assessment basic-In this, we will make our tax payment by monthly, we have to do as much as my B2B sales are happening.

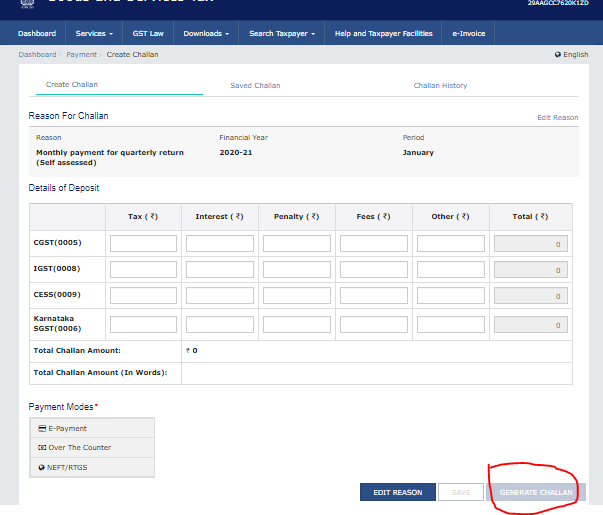

Final Step. After this, we will click on the process and Generate Challan for all the liabilities that I have so that our tax liabilities will be over.

- By following all these steps, we can pay our goods and service tax.

What are the options for making payment of tax under QRMP Scheme?

We can pay tax in two ways within quarterly Return monthly payment.

(a) Fixed Sum Method:- In this, we have to pay our tax according to the two months’ tax of our previous quarters, that means we will have to pay 35% tax of the two months we have paid in our last quarter and when the last quarter comes So whatever is our remaining tax in it, we will pay it after calculating it. And if we paid the monthly tax in the last quarter, then we have to pay 100% of the tax for the first month and second month. Whatever we paid tax in the last month.

(b) Self-Assessment Method:- According to this method, we will pay our tax according to our monthly transaction meaning that we will pay our tax according to B2B whatever we have sold, as per our income tax credit we show from it. We will minus our sales and we will pay whatever net amount comes.

What are the late fees under QRMP scheme?

| GST | LATE FESS PER DAY | LATE FEES PER DAY(IF NIL) |

| CGST | 25rs | 10rs |

| SGST | 25rs | 10rs |

| IGST | 50rs | 20rs |