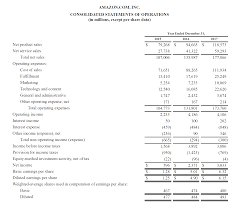

- What is Profit And Loss Account?

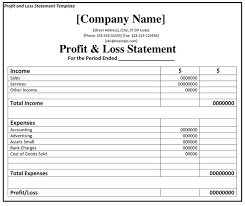

To know about the profit of the business, we have to look at the profit and loss account of that company, then it tells us that my company has earned profit or loss in that financial year. So for this, we have to create a profit and loss account of the company, in which we get to know how much we have sold in our company and how much has been spent to run the company. So when we need to know this, we know about it from the Profit and Loss Statement.

NET PROFIT = INCOME – EXPENSE

SOME BASIC TOPIC OF PROFIT AND LOSS FINANCIAL STATEMENT

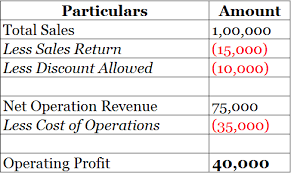

- REVENUE FORM OPERATION:-Whatever profit is due to my business due to its work means our Sales and our business gets profit due to anything, then we Called it revenue from operation.

HOW TO CALCULATE THE REVENUE FROM OPERATION

| Total Sales | 1000 | |

| Less(-) | Sales Return | (200) |

| Add(+) | Interest Income, Dividend Income, Revenue from other Service | 100 |

| Revenue From Operation | 900 |

- OTHER INCOME:- This is my income that is not related to running the business, in which we have to profit from any other. Like Interest Received On Fixed Deposit, E-Coupon.

- TOTAL REVENUE:- When we come to know our total sales, then we add our other income to it, then it is called my total revenue. (Revenue From Operation + Other Income = Total Revenue From Operation )

2. Expenses

All the money that is put into running a business. So that business does not suffer loss and if the business runs properly, then the money invested in running a business is called an expense for us.

(a)Direct Expense:- Expense like that, in any business, I know that there will be an increase in my expenses from which no company can survive, it will cost that much, then we called it a direct expenditure. like salary, raw materials, manufacturing supplies, customer service, etc.

(b)Finance cost:- This is a cost in which we have taken a loan from a bank and we have to pay its interest. This is what we called finance cost.

(c)Administration and other expenses:- Expense whose effect is directly on the business, such as giving a salary, paying rent, paying electricity bills.

When the profit and loss statement of a private limited company is made, we can calculate the total expenditure by adding these three.

Extraordinary items:- When a company once profits from selling a product. And selling that product was not the company’s professional work. And neither was this profit company to get every year, this happened only once in a sudden year. Now, this profit will neither happen in the coming year nor last year. So this is what we called extraordinary and exceptional items and when there is a profit of 10 lakhs in any company, then extra-ordinary items are counted in it.

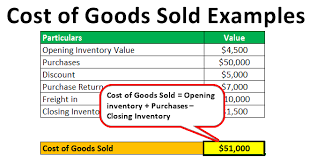

- Calculation Of Cost of Goods Sold

To calculate the cost of goods sold for any company, we must first know the raw material purchases of the company, how much money it cost to bring the raw material purchases of the company. By adding all of these, you can calculate the cost of goods sold by any company, if you lose the remaining well.

| purchase raw materials | 10000 |

| Add(+) Direct Expense | 250 |

| Less(-) Closing Stocks | 500 |

| Cost of Goods Sold | 9750 |