What is company balance Sheets?

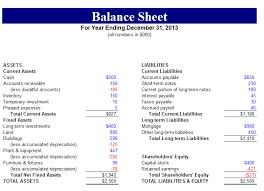

In The Balance Sheets, all the assets and all the liabilities of any company are fully accounted for. This shows us how much loan we have taken. How many debaters do we have? How many are Creditors? How many shareholders are holding our shares? What are the fixed assets of the entire company? What is the depreciation charge in which of the assets and after that the depreciation of the assets we have charged after that, how much I have decreased, how much are the short-term loans? All of these are accounted for in the balance sheets of any company, so that the company can know whether it is a loss or profit in the financial year.

1.Equity & liabilities :- Company’s Owner money’s Called Equity & liabilities

- Share Holder Fund (This fund is divided into Three categories )

a. Share Capital:- This shows us how much money has been invested in the company

b. Reserve & Surplus:- This is the profit of our company that we keep for our employees like General Reserve, Security Premium, Debenture Redemption Reserve, all of them come under it.

c. Money Received against share warrants:- These are also like a share of our company, from which we issue our shares as a warrant.

- Share Application money pending:- This means that we have not yet become a shareholder, our holder ship is pending.

2. Non Current liabilities (under this liabilities is divided in to 4 category)

a. Long Term borrowing:- A loan that we cannot pay within 1 year

b. Deferred Tax liabilities(Net):- There are changes in income tax and finance inside it, so if we keep an amount inside it, then it means that we have added it to the future.

c. Other long Term liabilities:- If we write any machine or goods that we take as installment, we write them in it

d. Short-Term provisions:- In this, the company is given its own small provision for its shareholders, which we give as a dividend,

3. Current liabilities:-A Loan We pay Within 1 Year (Under This Liabilities Divided into 3 categories)

a. Short Term Borrowing:- If we have taken a cash from someone and we peddle it within 1 year, then we called Short Term Borrowing.

b. Trade payable:- Whatever creditors and bills are available in our company, we write them in it. This means we purchase any goods from wherever we are called our creditor.

C. Other Current Liabilities And provision:- When we give a customer advance to buy some goods, we called it other current liabilities.

ASSETS

- Non-Current Assets:- The kind of assets that we cannot change as cash in 1 year. it is divided into 5 parts

(a) Fixed Assets:- These are assets that we do not buy to sale in the company. (Furniture, Fixture, machine, etc.

- Tangible Assets:– These are the assets that we can see and touch. Like furniture, machinery, building, etc.

- Intangible Assets:- We cannot see and touch on such assets like Goodwill, Copyright, patent, etc.

- Capital Work In progress:- This means that the capital of my company that is being created has not been created yet. Like building, machinery

- Intangible Assets under development:- We can explain it in such a way that we are investing in the assets that we are making for our business, but we cannot see or touch it, then we will add the amount in this column.

- Fixed Assets Held For Sale:- This is our fixed assets column. If we have any fixed assets that we have to sale, then we will write the amount of it in it.

(b) Non-Current Investments:- This is the same investment of any company that we invest in any other place and we cannot receive it within 1 year. This means that it is the cash of my company which is the remaining money.

(c)Deferred Tax Assets(net):- We can explain it in such a way that it would be such tax that can become assets for us in the future as both income tax and corporate rules are different.

(d)Long Term Loans & Advance:- When we give money from our business to another person for his business. So that his business is developed, he becomes my debtor.

(e)Other Non-Current Assets:- These are the fixed assets of my company that we did when we started the company when the company was getting registered, or we give a discount on the issue to someone. Inside this, our PreliminaryExpense also comes. And we showed it for a long time in our company’s balance sheets.

Current Assets

(a)Current Investment:- If we invest our money at someplace and change it into cash within 1 year, then we called it a current investment.

(b)Inventories:- This investment is my investment, which we can change in cash within 1 year. Our stock and Consumables Goods come in it. Consumables are not meant to be used to sell oil, petrol, griss in the company, but we use them in our business.

(c)Trade Receivables:- When we borrow any person, we sale some goods, and some of our bills are available from which we have to make money. Due to which our business gets profit. Therefore, this is called our trade receivable.

(d)Cash & Cash Equivalents:- This tells our company cash how much cash we are going to get.

(e)Short Term Loan & Advance:- When a company gives money to someone and it gets received within 1 year, then we called it short term loan and advance.

(f)Other Current Assets:- Inside this and whatever is my remaining assets that we receive within 1 year, we write them inside it.