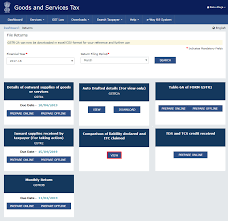

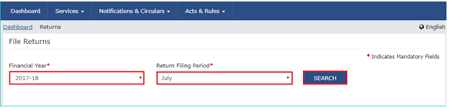

When we open (3B), a report opens in front of us, in which we file all the details of that, only then we can file our returns, in which we are asked about our turnover, which we can tick by the entire column. After that, our Return Dashboard opens.

*First of all, we are asked whether you have any nil return or not.

*In the second, we are asked whether we have supplied anything, whether it is Nil Rated or exempted or non-GST, so we have to do yes in this column. And if it doesn’t, then no has to be done.

A reverse charge is also counted in this column. This means that. When we are unable to charge a person from whom we are not able to charge tax, then we charge RCM. This means that whoever pays the tax will pay tax to the direct government. Not anyone else. This table number 3.1 I am entered.

*Third If I have an interstate supply in this column or we supply the goods to an unregistered person who is not a registrar in GST, then we have to tick this column.

*fourth In this, if we provide a service, we can claim for Goods as well as Service Tax for input tax credit and if there is any reverse charge, we can also claim it. So we have to tick it

*fifth If we have received a nil rated or non-GST supply, then we have to tick this column. We also have to tick it for the Exempt supply.

*sixth If a company returns a late fee of GST due to which it has to pay interest, then we have to tick it too.