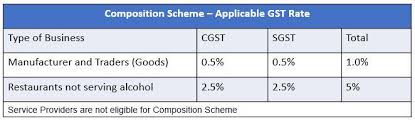

These are the most points of composition scheme because any company accepts this scheme. Because the rates of tax in this are levied at a special rate pay tax. Whatever rates are inside it are special rates.

- The rate of tax at the favorable rate is the percentage of turnover, which means that the person who pays his turn over has to pay tax.

- Whatever tax the traders will have will be one percent of taxable turnover. Because in this we have to pay a tax of only, which we are paying tax on, else we will not have to pay tax.

- In the case of restaurants, we have to pay five percent of the turnover.

Return system under composition scheme

in this, we have to file only four returns in the year. Which is to be filed on Quartly Basic. In this, any out word supply has to be given separately. In this, we have to give a single return, you have to file quarterly basic in the file of GSTR Four. And after the end of the year, a return file has to be filed GSTR 9(A)

In this month, you have a complete monthly turnover and if you have made a mistake on Quartelli Basic, then you can rectify your mistake in it.

Some important points under composition scheme

In this, no dealer can supply interstate means that it cannot supply or sell out the word. If we enter the enter state of any amount, then in that case that person will be excluded from this GST scheme.

Whoever is a composition dealer cannot show tax invoices as they are the rate of tax and do not have any kind of credit sale, hence we cannot issue a tax invoices. Rather, he has to issue a bill of supply instead. And in it, complete details have to be given for their services. And if there is a man who is providing services for restaurants, then he also has a normal limit which is ten percent of turnover in state and five lakh with this higher. Meaning, no one can provide more service than what comes from these two. Earlier, if a manufacturer was providing service, then its scheme was taken from it. But now if you are providing service, you can also provide service within your limit. This will not take your scheme from you.